(INTRODUCTION- Why Dental Health Is Not Covered by Health Insurance in India?)

Dental problems are among the most common health issues faced by Indians. From cavities and gum infections to wisdom tooth extractions, almost everyone needs dental care at some point. Yet, when people check their health insurance policy, dental treatment is usually missing.

So why dental health is not covered by health insurance in India— even though it directly affects overall health?

Let’s break this down in a simple, practical way.

The Current State of Dental Coverage in India

In most standard health insurance policies in India:

- Routine dental checkups are not covered

- Fillings, root canals, braces, and cleanings are excluded

- Dental treatment is covered only if caused by an accident

This exclusion applies across:

- Individual health insurance plans

- Family floater plans

- Even many corporate group policies

To understand why, we need to look at how insurance actually works.

How Health Insurance Works (At Its Core)

Health insurance is designed to cover:

- Unpredictable

- High-cost

- Medically necessary events

Examples:

- Hospitalization

- Surgeries

- Critical illnesses

You can read more about this risk model in our guide on How Health Insurance Companies Make Money.

Dental care doesn’t fit neatly into this model.

1. Dental Treatments Are Predictable and Frequent

Most dental procedures are:

- Planned

- Preventive

- Recurring

For example:

- Annual cleanings

- Cavity fillings

- Orthodontic adjustments

From an insurer’s perspective, this creates a problem:

If everyone is guaranteed to claim dental expenses, premiums would rise sharply.

Insurance works best when only a small percentage of people claim at any given time. Dental care breaks this balance.

2. Dental Care Is Largely Preventive, Not Emergency-Based

Health insurance in India is hospitalization-centric.

Dental care, however:

- Rarely requires hospital admission

- Is mostly outpatient (OPD)

- Focuses on prevention rather than emergencies

Since OPD coverage itself is limited in India, dental treatment naturally falls outside the core scope.

3. High Claim Frequency, Low Claim Value

Dental treatments usually:

- Cost relatively less per procedure

- But are claimed very frequently

This combination is dangerous for insurers:

- High administrative costs

- Low margins

- Higher risk of misuse

This is the same reason why OPD consultations and medicines are often excluded or capped.

4. Difficulty in Standardizing Dental Costs

Dental treatment pricing in India varies wildly:

- City vs small town

- Private clinic vs hospital

- Dentist’s experience

- Materials used

Unlike hospital procedures that follow standardized billing codes, dental billing is less uniform, making it harder to:

- Audit claims

- Control fraud

- Maintain pricing consistency

5. Dental Problems Are Often Linked to Lifestyle Choices

Insurers consider moral hazard while designing policies.

Dental issues are often influenced by:

- Oral hygiene habits

- Tobacco use

- Diet and sugar intake

- Delayed treatment

Insurance generally avoids covering conditions where prevention is largely in the policyholder’s control.

When Is Dental Treatment Covered in India?

There are exceptions.

—Dental Treatment Due to Accidents

If dental damage occurs because of:

- Road accidents

- Falls

- Physical trauma

Then treatment may be covered as part of accidental hospitalization.

This is clearly mentioned in most policy wordings.

Are There Any Health Insurance Plans That Cover Dental Care?

Yes — but with limitations.

1. OPD Add-ons

Some insurers offer OPD riders that may include limited dental benefits, usually:

- With sub-limits

- With waiting periods

- At higher premiums

2. Corporate Group Insurance

Employer-provided group health plans sometimes include:

- Basic dental coverage

- Annual caps

- Restricted networks

However, coverage usually disappears once you leave the job.

Why Standalone Dental Insurance Is Rare in India

In countries like the US, standalone dental insurance exists. In India, it’s uncommon because:

- Out-of-pocket dental costs are relatively affordable

- Low consumer willingness to pay high premiums

- High claim predictability

As a result, insurers struggle to price dental-only products sustainably.

The Role of IRDAI (Insurance Regulator)

IRDAI has not mandated dental coverage so far.

The regulator allows insurers to innovate, but does not force inclusion of benefits that could:

- Increase premiums significantly

- Reduce affordability

- Lead to product misuse

You can read IRDAI’s broader health insurance guidelines on the official regulator website.

How This Affects Policyholders in India

For consumers, this means:

- Dental expenses are mostly out-of-pocket

- Preventive dental care becomes a personal responsibility

- Health insurance should not be chosen expecting dental coverage

This is why it’s crucial to understand policy inclusions properly before buying a plan.

We’ve covered this decision-making process in detail here:

👉 How to Determine Which Health Insurance Plan Is Best for You

Will Dental Coverage Become Common in the Future?

Possibly — but slowly.

Future trends may include:

- OPD-focused micro-insurance

- Preventive health packages

- Employer-driven dental benefits

- Subscription-based dental care models

But full-fledged dental coverage in standard health insurance is unlikely in the near future without significant premium increases.

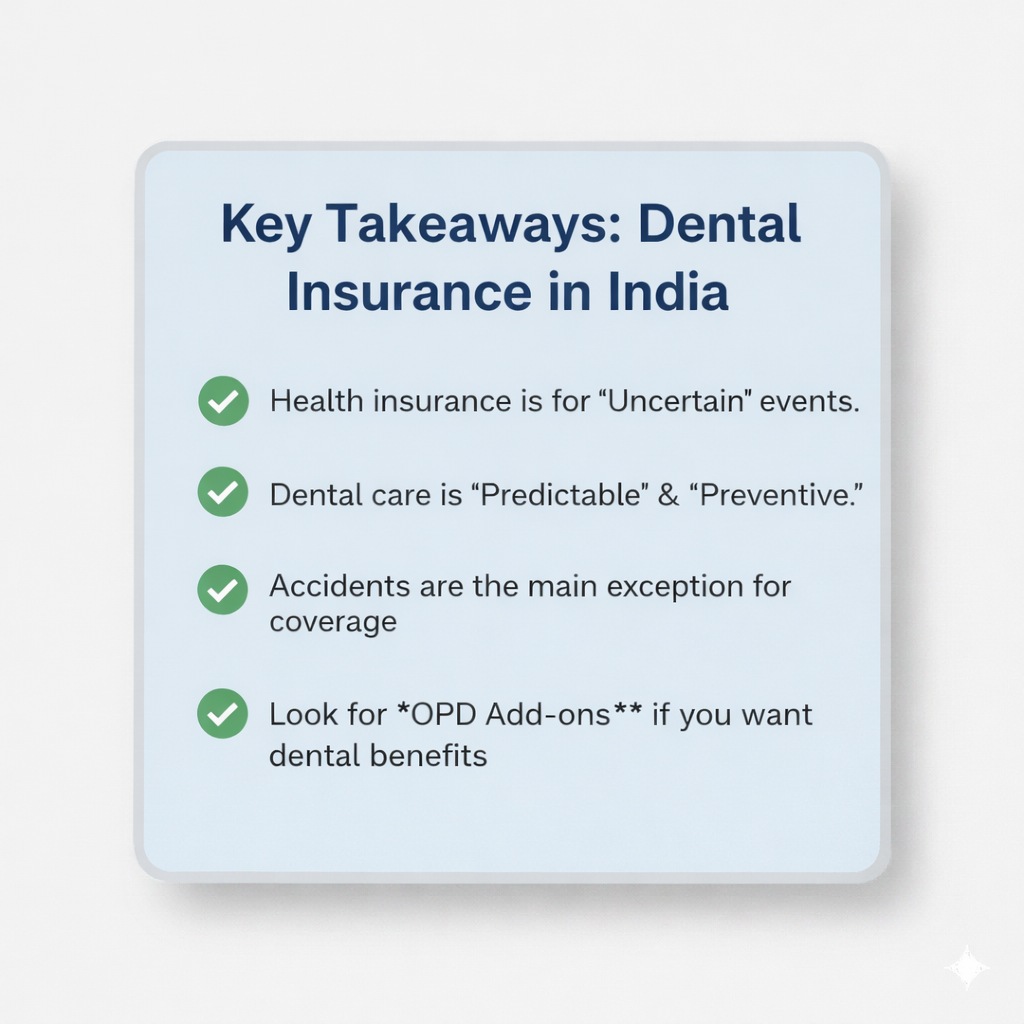

Key Takeaways

- Dental health is excluded because it’s predictable, frequent, and preventive

- Insurance works best for high-cost, uncertain events

- Dental care doesn’t fit the traditional insurance risk model

- Limited coverage exists via accidents, OPD riders, or corporate plans

- Understanding exclusions helps avoid disappointment during claims

FAQ- Why Dental Health Is Not Covered by Health Insurance in India?

1. Why is dental treatment not covered by health insurance in India?

Because dental care is considered routine and predictable, while health insurance mainly covers unexpected hospitalization expenses.

2. Do any health insurance plans in India cover dental treatment?

Most don’t. Some premium plans or OPD add-ons offer limited dental coverage with strict caps.

3. Is dental treatment covered if it’s due to an accident?

Yes, dental treatment may be covered if caused by an accident and requires hospitalization.

4. Can I buy separate dental insurance in India?

Standalone dental insurance is rare. Dental benefits are usually available only via OPD riders or corporate plans.

5. Will dental treatment be covered by health insurance in the future?

Limited dental coverage may expand, but full inclusion is unlikely anytime soon.