Room rent capping in health insurance is one of the most misunderstood clauses in Indian health insurance policies. Despite paying regular premiums and having adequate sum insured, many policyholders are shocked at the time of claim when they discover that a significant portion of their hospital bill is not reimbursed. This usually happens because of room rent capping.

In this detailed guide, we will explain what is Room Rent Capping in Health Insurance? The meaning of room rent capping in health insurance, how it works, its real impact on your hospital bills, and—most importantly—how you can avoid unnecessary out-of-pocket expenses.

What Is Room Rent Capping in Health Insurance?

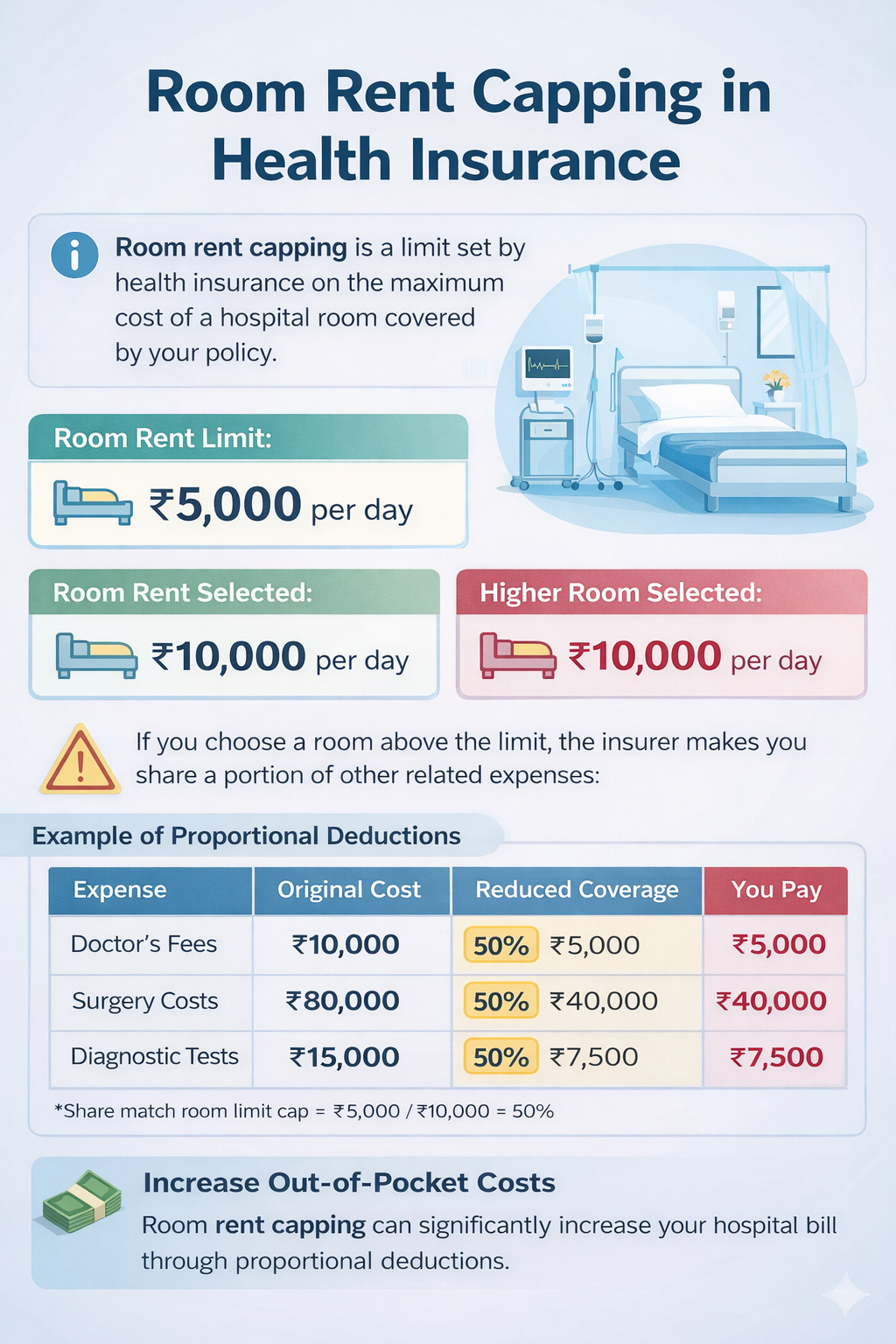

Room rent capping is a restriction placed by health insurers on the maximum hospital room rent that can be claimed during hospitalization. The cap may be defined as:

- A fixed amount per day (for example, ₹3,000 per day), or

- A percentage of the sum insured (for example, 1% of the sum insured per day)

If you choose a hospital room that costs more than the allowed limit, the insurer applies a proportional deduction on your entire hospital bill—not just the room rent.

This clause exists mainly in older or basic health insurance plans and is less common in modern no-room-rent-cap policies.

Why Do Health Insurance Policies Have Room Rent Capping?

Insurance companies introduce room rent capping to control claim costs and keep premiums affordable. Higher room categories often lead to higher overall treatment costs because:

- Doctor consultation fees increase

- Nursing charges go up

- Procedure and equipment costs may be higher

By limiting room rent, insurers attempt to standardize treatment expenses and manage risk pooling efficiently.

If you want to understand how insurers manage costs collectively, you can read our detailed guide on risk pooling in health insurance (internal link).

How Room Rent Capping Works (With a Simple Example)

Let’s understand this with a practical example:

- Sum insured: ₹5 lakh

- Room rent limit: 1% of sum insured = ₹5,000 per day

- Room chosen: ₹8,000 per day

Here, you exceed the allowed room rent by 60%. As a result, the insurer may apply a proportional deduction of 60% on eligible expenses such as:

- Doctor’s fees

- ICU charges (if applicable)

- OT charges

- Nursing and service costs

So even though your treatment is covered, a large portion of the bill may not be reimbursed.

Impact of Room Rent Capping on Your Hospital Bill

1. Proportional Deductions

The biggest impact of room rent capping is proportional deduction. This means the insurer reduces payouts across multiple cost heads, not just room rent.

2. Higher Out-of-Pocket Expenses

Policyholders often assume that only the excess room rent will be paid from their pocket. In reality, the final out-of-pocket expense can be substantially higher.

3. Claim Rejection Confusion

Many people mistake proportional deductions for claim rejection, leading to dissatisfaction and mistrust in health insurance.

If you’re interested in how claims work during restricted periods, you may also find our article on waiting periods in health insurance helpful.

Room Rent Capping vs No Room Rent Capping Plans

| Feature | With Room Rent Capping | No Room Rent Capping |

|---|---|---|

| Premium | Lower | Slightly higher |

| Flexibility | Limited | High |

| Risk of deductions | High | Minimal |

| Ideal for | Budget buyers | Comprehensive coverage seekers |

Modern policies increasingly offer no room rent cap, making them a better choice for urban healthcare costs.

How to Check Room Rent Capping in Your Policy

Before buying or renewing a health insurance policy, always:

- Read the policy wording carefully

- Check the “Limits and Sub-limits” section

- Ask your insurer or agent for written clarification

- Look for terms like “1% of sum insured” or “shared accommodation”

The Insurance Regulatory and Development Authority of India (IRDAI) also advises policyholders to understand sub-limits clearly. You can refer to consumer guidance published on the official IRDAI website.

How to Avoid Extra Costs Due to Room Rent Capping

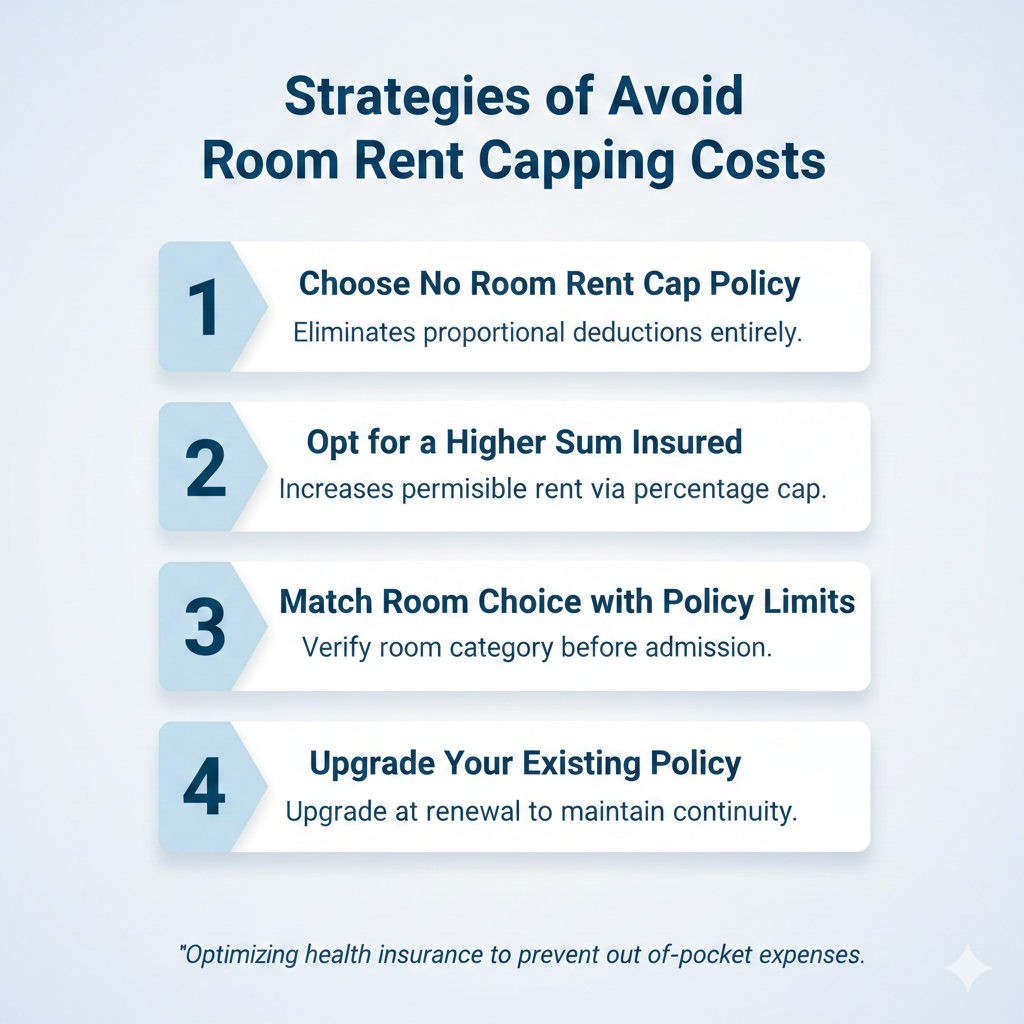

1. Choose a No Room Rent Cap Policy

This is the most effective way to avoid proportional deductions altogether. Most comprehensive health insurance plans today offer this feature.

2. Opt for a Higher Sum Insured

If your policy uses a percentage-based cap, a higher sum insured automatically increases your permissible room rent.

3. Match Hospital Room Choice With Policy Limits

Always confirm your eligible room category with the hospital’s insurance desk before admission.

4. Upgrade Your Existing Policy

Many insurers allow policy upgrades after renewal without restarting waiting periods, provided there is continuous coverage.

Is Room Rent Capping Still Relevant in 2025?

With rising hospitalization costs in India, room rent capping is becoming increasingly impractical, especially in metro cities. Shared rooms or capped rents may not even be available in many private hospitals.

As healthcare inflation continues to rise, policyholders are better served by transparent, no-sub-limit policies—even if they come at a slightly higher premium.

For broader regulatory updates and consumer-friendly reforms, you can explore public health insurance advisories from government portals such as the National Health Authority.

Key Takeaways

- Room rent capping limits how much room rent your insurer will cover

- Exceeding the limit triggers proportional deductions

- The impact goes far beyond room charges

- No-room-rent-cap policies offer better financial protection

- Always align your room choice with policy limits

Also read: Dental coverage exclusions in health insurance.

Frequently Asked Questions (FAQs)

1. What is room rent capping in health insurance?

Room rent capping is a limit set by insurers on the maximum hospital room rent they will reimburse during hospitalization.

2. Does room rent capping apply to ICU charges?

Usually no, but exceeding room rent limits can still affect other non-ICU expenses through proportional deductions.

3. Can room rent capping lead to claim rejection?

No, but it can significantly reduce the claim amount through deductions.

4. Are no room rent cap policies more expensive?

They may have slightly higher premiums but provide better coverage and fewer surprises at claim time.

5. How can I avoid proportional deductions?

By choosing a no-room-rent-cap policy or strictly staying within your policy’s room rent limit.