Term life insurance is often discussed using round numbers — ₹50 lakh, ₹1 crore, ₹2 crore — as if one figure can work for everyone. In reality, deciding how much term life insurance you need in India in 2026 is a personal financial calculation, not a rule-of-thumb exercise.

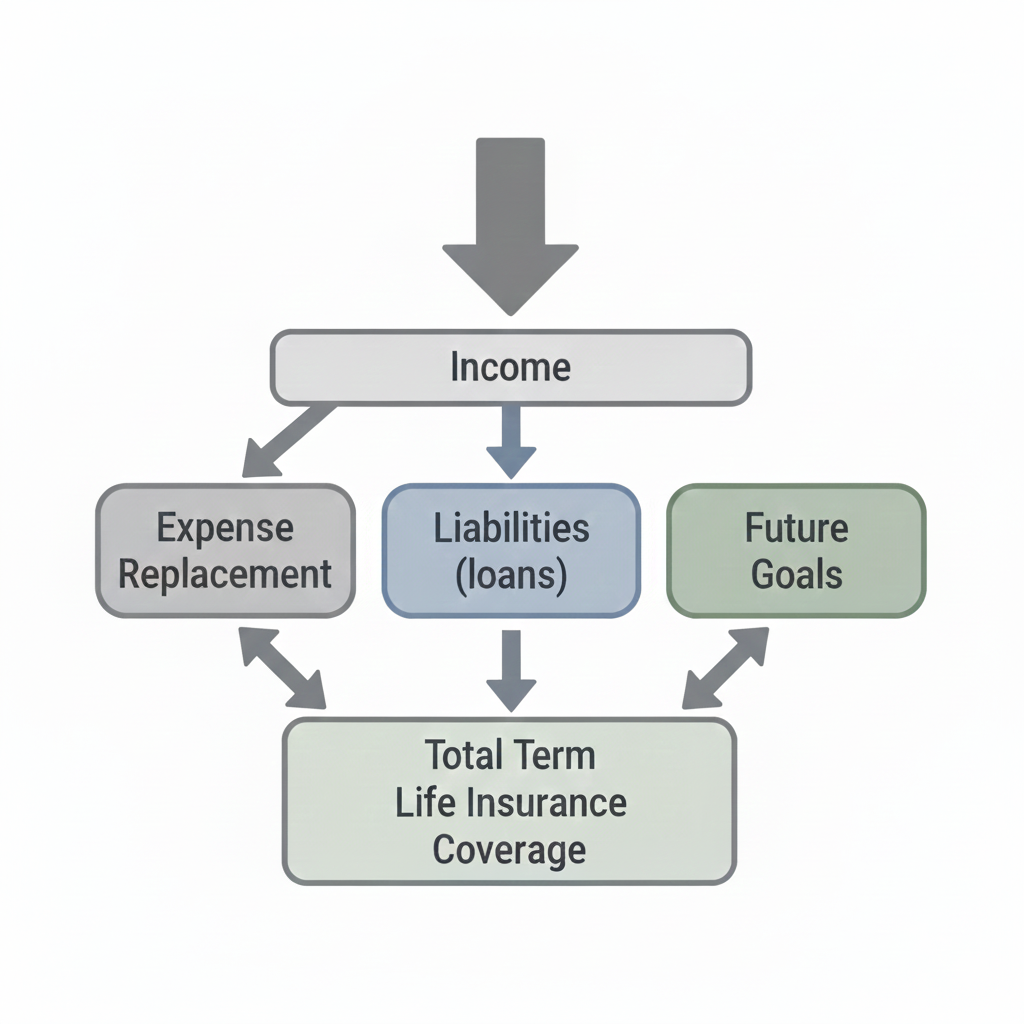

The right coverage amount depends on your income, financial dependants, outstanding liabilities, future goals, and the cost of maintaining your family’s lifestyle in your absence. This article explains how to determine that amount in a structured, practical, and realistic way — without sales pressure or oversimplified shortcuts.

Why Term Life Insurance Is a Core Financial Tool in 2026?

Over the last decade, Indian households have seen significant changes:

- Rising education and healthcare costs

- Higher reliance on long-term loans such as home EMIs

- Shift towards nuclear families with fewer fallback options

- Increasing gap between income growth and living expenses

In this environment, term life insurance acts as income protection, not as an investment or tax-saving product. Its purpose is straightforward:

to ensure your family can continue their financial life without disruption if your income suddenly stops.

What Term Life Insurance Actually Covers

A term life insurance policy pays a fixed sum assured to your nominee if you pass away during the policy term. There are no maturity benefits and no investment returns. This simplicity is precisely why term insurance is considered the most efficient form of life cover.

Regulators and consumer finance experts consistently recommend term insurance as the foundation of personal risk management, separate from investments such as mutual funds or retirement products.

The Core Question You Should Ask Before Choosing a Coverage Amount

Instead of starting with a number, start with this question:

“If I am not around tomorrow, how much money would my family realistically need to manage their financial life for the next 20–30 years?”

Your term insurance cover should be able to:

- Replace your income for dependent years

- Clear all outstanding loans

- Fund major life goals such as education

- Prevent financial dependence on relatives

Why Popular Thumb Rules Fall Short

The 10x–20x Income Rule

One commonly cited rule suggests buying term insurance equal to 10–20 times your annual income.

While this provides a rough starting point, it ignores:

- Your actual household expenses

- Length of financial dependency

- Inflation

- Existing assets and savings

As a result, two individuals earning the same salary may need vastly different coverage amounts.

The “₹1 Crore Is Enough” Assumption

₹1 crore has become a psychological benchmark in India, but in 2026, its adequacy depends entirely on context.

For a single individual with no liabilities, it may be sufficient. For a family with children, a home loan, and long-term goals, it may fall significantly short. Coverage adequacy should be based on needs, not popularity.

A Practical, Needs-Based Method to Calculate Term Insurance

Step 1: Estimate Annual Household Expenses

Include all recurring expenses required to maintain your family’s current lifestyle:

- Housing or rent

- Utilities and groceries

- Education costs

- Healthcare and insurance premiums

Example:

- Monthly expenses: ₹60,000

- Annual expenses: ₹7.2 lakh

Step 2: Identify the Dependency Period

Determine how long your dependants would rely on your income:

- Until children become financially independent

- Until your spouse reaches retirement age

Example:

- Dependency period: 25 years

- Income replacement requirement: ₹7.2 lakh × 25 = ₹1.8 crore

Step 3: Add Outstanding Liabilities

All loans should be fully covered to ensure your family does not inherit repayment obligations:

- Home loan

- Personal or car loans

- Education loans

Example:

- Total outstanding loans: ₹40 lakh

Step 4: Account for Major Future Goals

These may include:

- Children’s higher education

- Marriage expenses

- Retirement support for spouse

Example:

- Education and marriage goals: ₹50 lakh

- Retirement buffer: ₹30 lakh

Total future goals: ₹80 lakh

Step 5: Subtract Existing Assets and Insurance

Deduct:

- EPF, PPF, mutual funds

- Fixed deposits

- Existing life insurance cover

Example:

- Existing assets: ₹30 lakh

Putting It All Together

| Component | Amount |

|---|---|

| Living expense replacement | ₹1.8 crore |

| Outstanding liabilities | ₹40 lakh |

| Future goals | ₹80 lakh |

| Total requirement | ₹3 crore |

| Less existing assets | ₹30 lakh |

| Recommended cover | ~₹2.7 crore |

In practice, this would typically be rounded to ₹3 crore.

How Age and Life Stage Affect Coverage Needs

In Your 20s

- Lower expenses

- Fewer dependants

- Lowest premiums

Buying early allows you to lock in long-term affordability.

In Your 30s

- Marriage and children

- Home loans

- Peak responsibility phase

Coverage requirements often increase sharply during this stage.

In Your 40s

- Higher income

- Shorter earning window

- Rising medical risks

Adequate coverage becomes critical, but premiums are higher.

Inflation: The Most Commonly Ignored Factor

Inflation steadily erodes purchasing power. In India, education and healthcare inflation often exceed general inflation levels. This means a policy that looked sufficient years ago may no longer be adequate today.

When calculating coverage in 2026, it is essential to assume that future costs will be significantly higher than today’s figures.

One Policy or Multiple Policies?

Some individuals choose to split coverage into multiple term policies with different durations. This can align coverage with life stages and sometimes improve cost efficiency. However, the total coverage amount should still reflect overall financial needs.

Common Mistakes to Avoid

- Relying only on employer-provided life insurance

- Buying coverage solely for tax benefits

- Underestimating education and healthcare costs

- Choosing coverage based on peer decisions

Term life insurance is a personal financial decision and should be evaluated independently.

So, How Much Term Life Insurance Do You Need in India in 2026?

There is no universal answer, but broadly:

- ₹1–2 crore may suit individuals with limited dependants

- ₹2–4 crore is common for families with children and loans

- ₹5 crore or more may be required for higher incomes or metro lifestyles

The correct amount is one that protects your family’s financial stability, not one that simply sounds adequate.

Frequently Asked Questions (FAQs)

1. How much term life insurance do I need in India in 2026?

The required coverage depends on your income, expenses, dependants, liabilities, and future goals. While 10–20 times annual income is often used as a reference, a needs-based calculation provides a more accurate figure.

2. Is ₹1 crore term insurance enough?

₹1 crore may be sufficient for individuals with low expenses and no major financial responsibilities. For families with children, home loans, and long-term goals, it may not be adequate in 2026.

3. Does inflation affect how much term insurance I should buy?

Yes. Inflation significantly increases future costs, especially education and healthcare. Ignoring inflation can result in underinsurance.

4. Is employer-provided life insurance sufficient?

Employer-provided cover is usually limited and ends when you leave the job. It should not be considered a replacement for personal term life insurance.

5. Is it better to buy term life insurance early?

Buying early helps lock in lower premiums and ensures coverage before health issues arise, making it financially efficient over the long term.