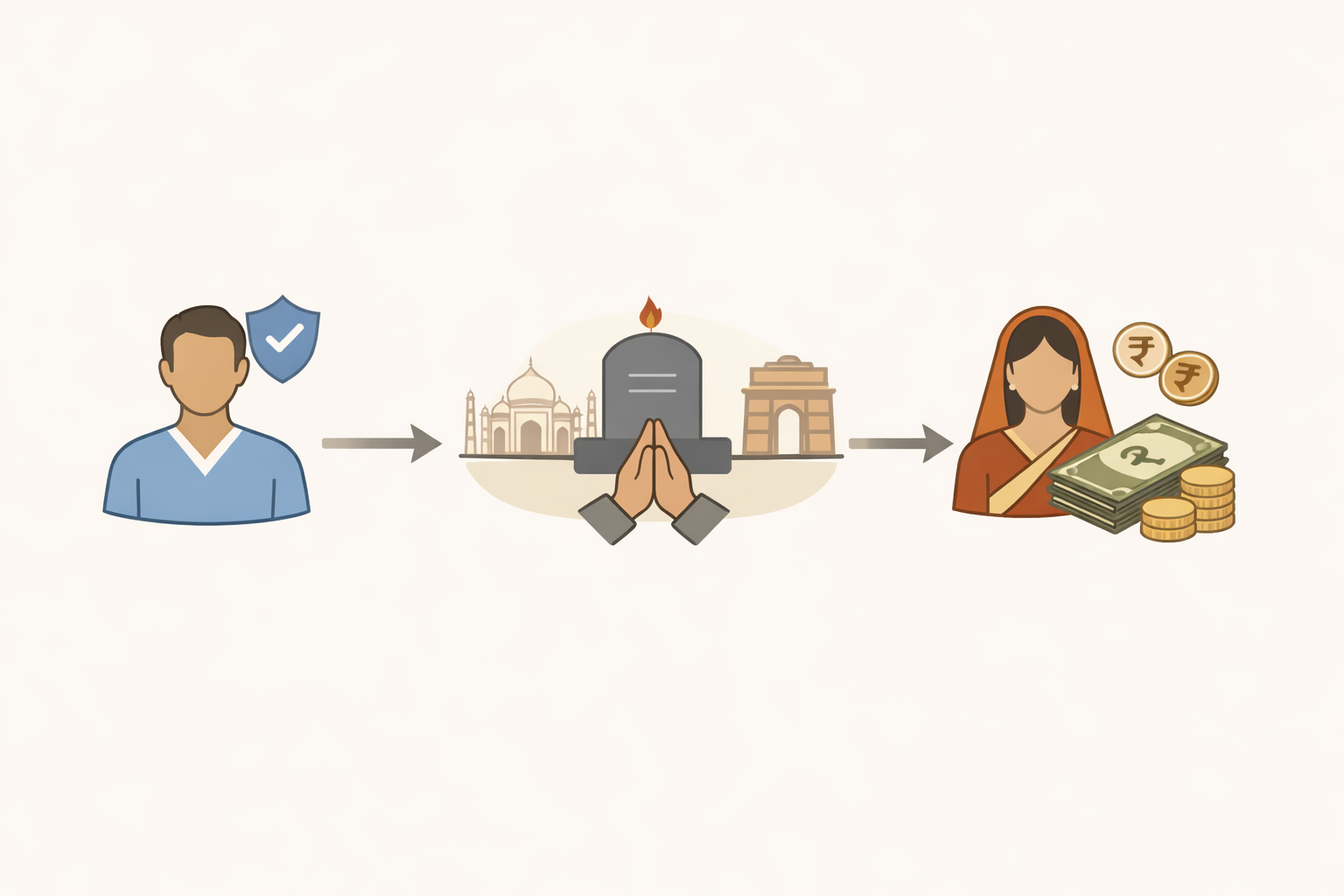

In a country that’s home to over 1.4 billion people and where a large portion of the population doesn’t have formal life insurance, social security schemes introduced by the Government of India play a crucial role in financial inclusion. Among these, the PMJJBY life insurance scheme stands out as a low-cost, high-impact safety net that provides life cover for millions of Indians at an exceptionally affordable price.

Launched with a vision to expand insurance penetration — especially among those who otherwise might not opt for life insurance — the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) has made financial protection accessible to even the most economically vulnerable families. Let’s deep-dive into what the PMJJBY life insurance scheme is, how it works, who can benefit, and how to enroll and claim benefits.

What Is the PMJJBY Life Insurance Scheme?

The PMJJBY life insurance scheme is a government-backed term life insurance product designed to offer financial protection in the event of the policyholder’s death due to any cause. It’s a pure term insurance plan, which means:

- There’s no investment or savings component — it’s strictly insurance.

- The entire benefit is paid only on death, not on maturity or survival. (Department of Financial Services)

Under the scheme’s standard terms, eligible subscribers receive a life cover of ₹2,00,000 (two lakh rupees). This payout goes to the nominee or beneficiary listed in the policy when the covered individual passes away during the policy period. (mint)

The idea behind the PMJJBY life insurance scheme is simple yet powerful: even if a primary earner in a family dies unexpectedly, a small financial cushion exists to manage immediate expenses like funeral costs, debt payments, or short-term income loss.

Affordable Premium: Only ₹436 per Year

One of the biggest advantages and the most talked-about feature of the PMJJBY life insurance scheme is its incredibly low annual premium:

₹436 per year (auto-debited from your savings or post office account). (Department of Financial Services)

That’s less than ₹40 per month, yet it provides life cover of ₹2 lakh. This affordability is what has made the scheme popular — especially among low-income families and individuals who have never bought insurance before.

The premium is collected through an auto-debit mandate — once a year — from the bank account or post office account you designate. It’s important to ensure there are sufficient funds in your account around late May each year so the scheme can renew your coverage for the next period (1st June through 31st May).

Who Is Eligible for PMJJBY?

Eligibility for the PMJJBY life insurance scheme is straightforward:

- Age: Anyone (Indian citizen) between 18 and 50 years of age

- Account: Must have a savings bank account or a post office savings account

- Consent: You must provide consent for auto-debit of the premium from your account

This simplicity in eligibility is intentional. The Government of India wants to ensure that even those without prior insurance experience can participate.

If you first enroll before reaching 50 years of age and continue to pay the premium regularly, your coverage can continue annually up to the age of 55 years.

What Does the PMJJBY Life Insurance Scheme Cover?

The primary focus of the PMJJBY life insurance scheme is to offer term life cover — which means protection in the event of the policyholder’s death. Key coverage aspects include:

Death Due to Any Reason

The plan covers death regardless of the cause, whether natural or accidental, provided the death occurs during the active policy period (June 1 to May 31).

Lien Period

For new subscribers, there is a 30-day waiting period (lien period) from the date of enrollment. If a non-accidental death occurs within this window, claims won’t be admissible. However, accidental deaths are covered even during the lien period.

This provision helps prevent misuse and aligns risk for the insurers administering the scheme.

How to Enroll in the PMJJBY Life Insurance Scheme

Enrollment in the PMJJBY life insurance scheme is designed to be simple and accessible:

Via Your Bank or Post Office

Most major banks and post offices across India offer PMJJBY enrollment. You can sign up:

- At your bank branch or post office counter

- By submitting a consent-cum-declaration form

- With your Aadhaar-linked savings account in place

Auto-Debit Authorization

You must provide consent for annual auto-debit of the ₹436 premium. Once this is done, your coverage runs from June 1 to the following May 31.

Renewal

Each year, premium renewal is automatic if there are sufficient funds in your account by late May. You don’t need to re-apply unless you cancel the scheme or change your bank account.

The entire process is nominally simple, but make sure you receive or retain an acknowledgement slip from the bank or post office — it’s crucial if you need to file a claim later.

Claim Process: How Your Nominee Gets the Benefit

One of the strongest selling points of the PMJJBY life insurance scheme is its claim settlement process, which is generally faster and simpler compared to traditional life insurance policies.

Here’s how it typically works:

1. Report the Death

The nominee or family member reports the policyholder’s death to the bank or the insurance company administering the scheme.

2. Document Submission

Common documents required include:

- Death certificate

- Policyholder’s bank account details

- Proof of nomination

When done properly, the insurance company issues the claim amount (₹2 lakh) directly to the nominee’s bank account.

Many banks and insurance companies work together to expedite this process, with LIC of India often acting as the primary administrator under the PMJJBY framework. (Department of Financial Services)

Real-World Impact and Reach of PMJJBY

The reach and impact of the PMJJBY life insurance scheme have been impressive since its launch. According to data from the Indian Government:

- Over 23 crore individuals were enrolled in the scheme as of March 2025.

- The scheme has helped settle claims amounting to thousands of crores of rupees, providing crucial financial support to bereaved families.

These figures illustrate the scheme’s scale and its role in expanding the social security net across both urban and rural India.

Benefits at a Glance

| Feature | Details |

|---|---|

| Scheme Name | Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) |

| Type | Term life insurance |

| Annual Premium | ₹436 (auto-debit) |

| Coverage Amount | ₹2,00,000 |

| Eligibility | 18–50 years of age with a savings or post office account |

| Coverage Period | 1 June – 31 May each year |

| Lien Period | First 30 days for non-accidental deaths |

| Enrollment Location | Bank/Post Office |

| Claim Beneficiary | Nominee |

| Tax Benefit | Premium eligible under Section 80C (as per tax norms) (Kotak Life) |

Common Mistakes to Avoid

Even though the PMJJBY life insurance scheme is simple, some common pitfalls include:

- Not having sufficient balance in your account around renewal time (late May), which can cause non-renewal.

- Not retaining acknowledgment slips — essential if you need to file a claim.

- Assuming enrollment happens automatically — consent is legally required though some users report unwanted debits without explicit consent (this is a complaint mentioned by some account holders).

If your bank debits premium without your consent, you can file a formal complaint with the bank or even escalate to the RBI Ombudsman for resolution.

Conclusion: Is PMJJBY Worth It?

The PMJJBY life insurance scheme is one of the most accessible and affordable life insurance options in India today. With a nominal annual premium of ₹436, it offers a straightforward and immediate safety net that can make a real difference for families if the unexpected happens. While it’s not a substitute for comprehensive life insurance plans with higher coverage, riders, or investment components, for its purpose — basic financial protection for the uninsured — it performs admirably.

To explore official details and read FAQs straight from the source, visit the Department of Financial Services website or check the India Post PMJJBY page. (Department of Financial Services)

Frequently Asked Questions (FAQs)

1. What is the annual premium for the PMJJBY life insurance scheme?

The standard annual premium is ₹436, which is auto-debited from your bank or post office account.

2. Who is eligible to enroll in PMJJBY?

Indian Individuals aged 18 to 50 years with a savings bank or post office account can join the scheme.

3. What is the coverage amount under PMJJBY?

The scheme provides a life insurance cover of ₹2,00,000 payable to the nominee upon the policyholder’s death.

4. Does PMJJBY cover death due to natural causes?

Yes, death due to any cause is covered, except during the 30-day lien period for new enrollees (accidental death is covered even then).

5. Can I renew my PMJJBY policy every year?

Yes, as long as you keep the ₹436 premium paid annually through auto-debit, your coverage will renew for another year automatically.