Let’s be honest: nobody buys health insurance because they enjoy reading 40-page policy documents. You buy it for that 2:00 AM hospital lobby moment when you’re stressed out and just want to know one thing:

“Will the insurer pay this claim, or am I stuck with a ruinous bill?”

In the world of health insurance, we use a lot of fancy terms to describe “peace of mind.” The biggest one is the Claim Settlement Ratio (CSR). But as we head into 2026, the game has changed. A high percentage on a shiny brochure doesn’t always mean your hospital stay will be stress-free.

Here’s the no-nonsense truth about whether CSR actually matters — and what you should be looking at instead.

What Is Claim Settlement Ratio (CSR)?

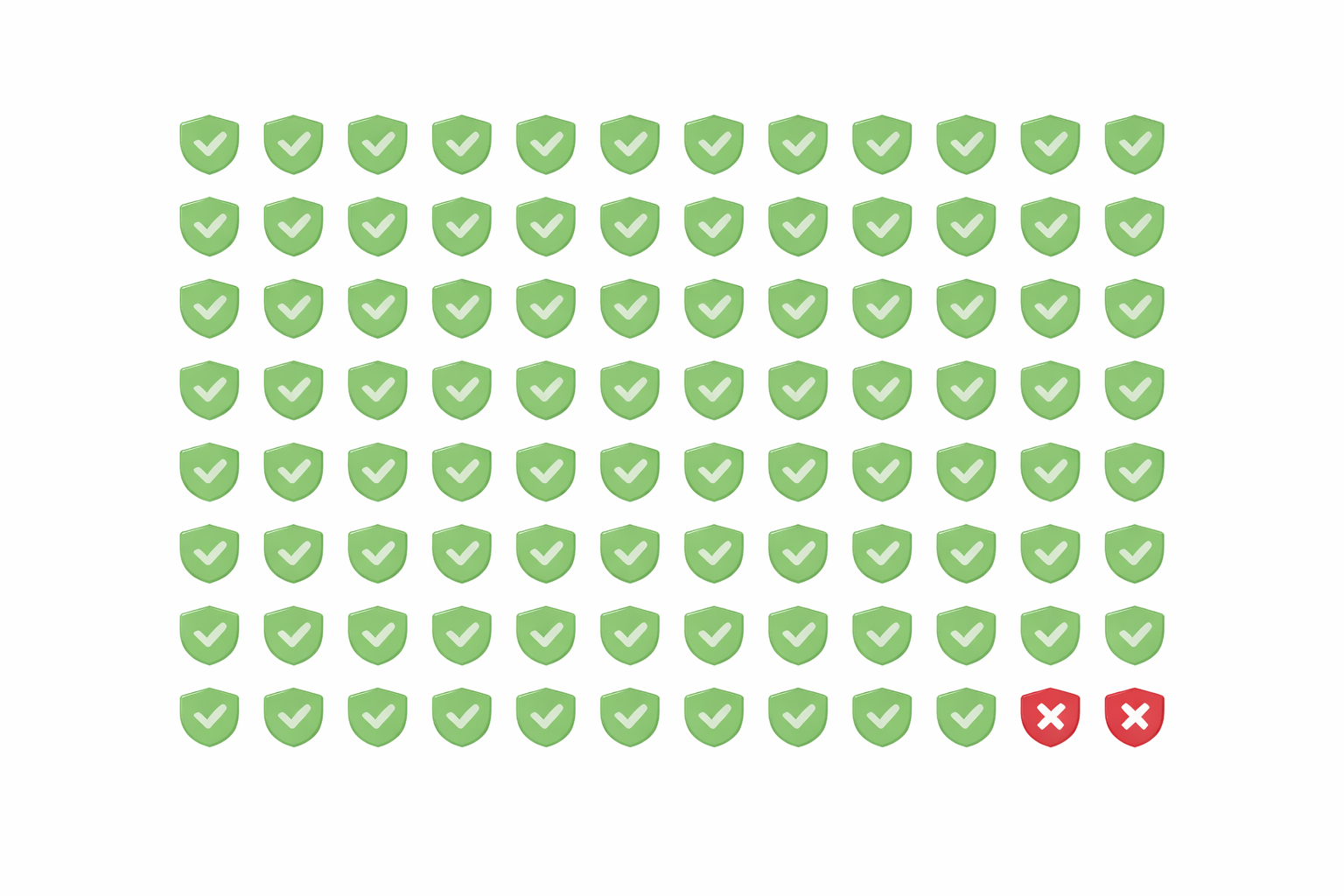

Claim Settlement Ratio (CSR) is the percentage of claims an insurance company pays out compared to the total claims it receives in a financial year, as reported to the IRDAI (Insurance Regulatory and Development Authority of India).

So if an insurer has a CSR of 97%, it means it settled 97 out of every 100 claims received.

But — and this is important — a settled claim on paper doesn’t always feel like a win in real life.

So… Does Claim Settlement Ratio Really Matter in 2026?

Yes — but it’s not the whole story.

In 2026, looking only at CSR is like checking the weather by looking at yesterday’s satellite photo. It tells you what happened, but not what’s happening right now or how severe the storm could be.

Here’s what else you should consider:

What CSR Tells You — And What It Doesn’t

| Metric | What It Tells You | Why It Matters |

|---|---|---|

| CSR | % of claims settled | Filters out clearly poor performers |

| Incurred Claim Ratio (ICR) | How much money they pay out vs. collect | Shows fairness in payouts |

| Claim Turnaround Time (TAT) | Time taken to settle claims | Affects your real-world hospital experience |

1. The “Hidden” Rejections

Insurance companies have become very smart at managing CSR numbers. Because CSR counts any payout as a settled claim, some companies will settle claims by paying only a fraction of the bill — just enough to keep their CSR high.

This might technically be a “settlement,” but financially it can feel like a rejection if most of your bill is still on you.

This is similar to how room rent capping silently reduces your total payout, even though the claim itself is accepted.

2. The Speed Factor in 2026

Thanks to evolving IRDAI regulations and faster digital processing, claim speed matters more than ever. If you’re stuck waiting 6+ hours in the discharge lounge because paperwork is slow — even with a “99% CSR” company — that ratio won’t comfort you.

Speed of documentation, ease of cashless claims, and responsiveness at the hospital desk are now just as important as the numeric ratio.

3. Consistency Over Hype

A company boasting “100% CSR this year” might look shiny on the surface. But consistency over multiple years — especially in both CSR and claim experience — matters more.

Trust companies that:

- Have solid CSR numbers year after year

- Maintain healthy Incurred Claim Ratios (ICR)

- Show stable growth without big spikes or drops

Important Metrics to Check Alongside CSR

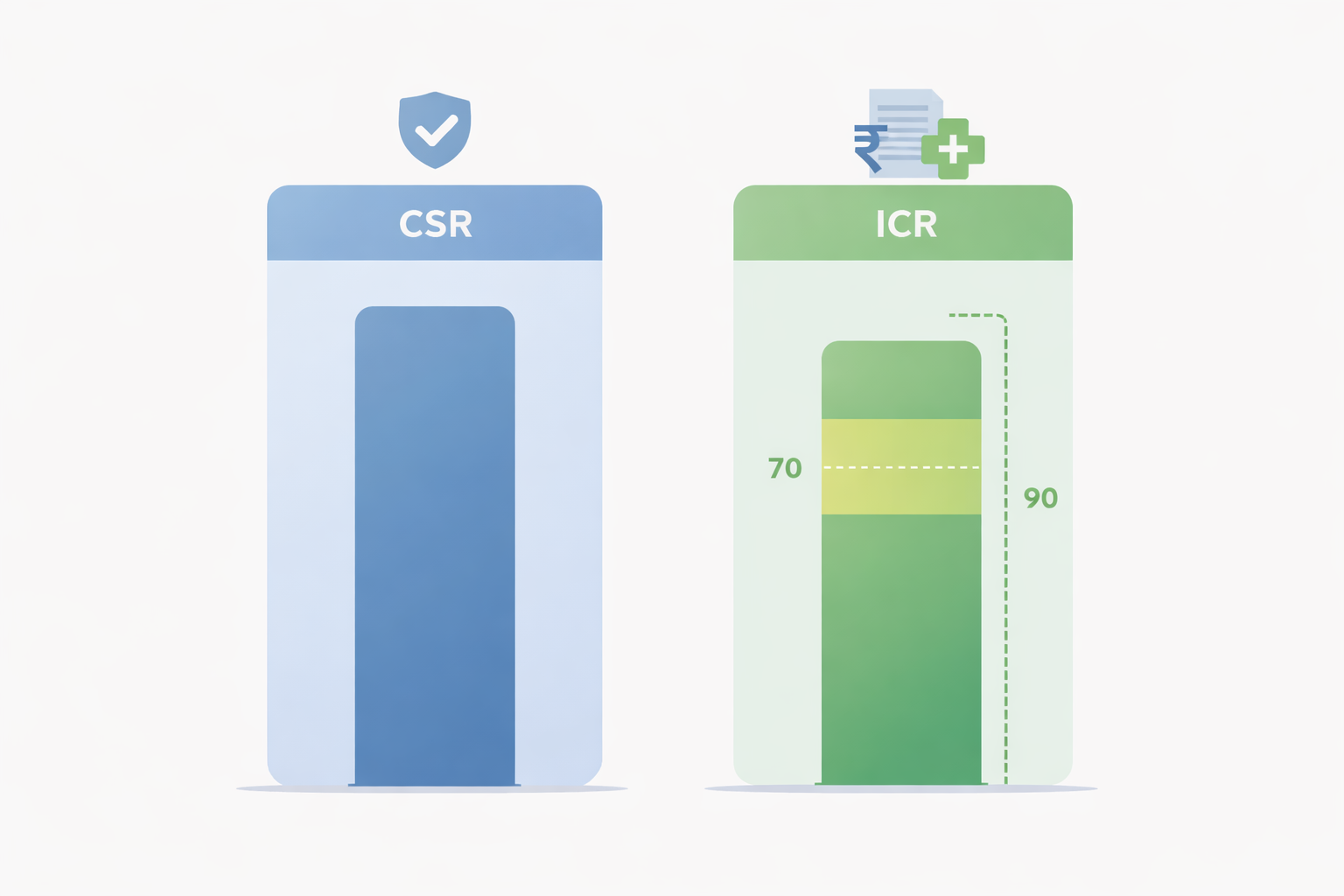

- Incurred Claim Ratio (ICR)

This is the insurance company’s “generosity meter.” It measures how much the insurer pays out in claims relative to the premiums it collects.

Too low → they may be stingy

Too high → may be financially unstable

A typical “sweet spot” in India tends to be 70–90%, but always check the context.

- Cashless Network Size

A large list of network hospitals means more seamless claim processing when you actually need it.

- Claim Turnaround Times

Faster settlements mean fewer hassles and less stress at the hospital.

- In-House vs. TPA Processing

Insurers with in-house claims teams often provide smoother coordination than those outsourcing to a third-party administrator (TPA), especially during emergencies.

How to Compare Policies Without the Stress

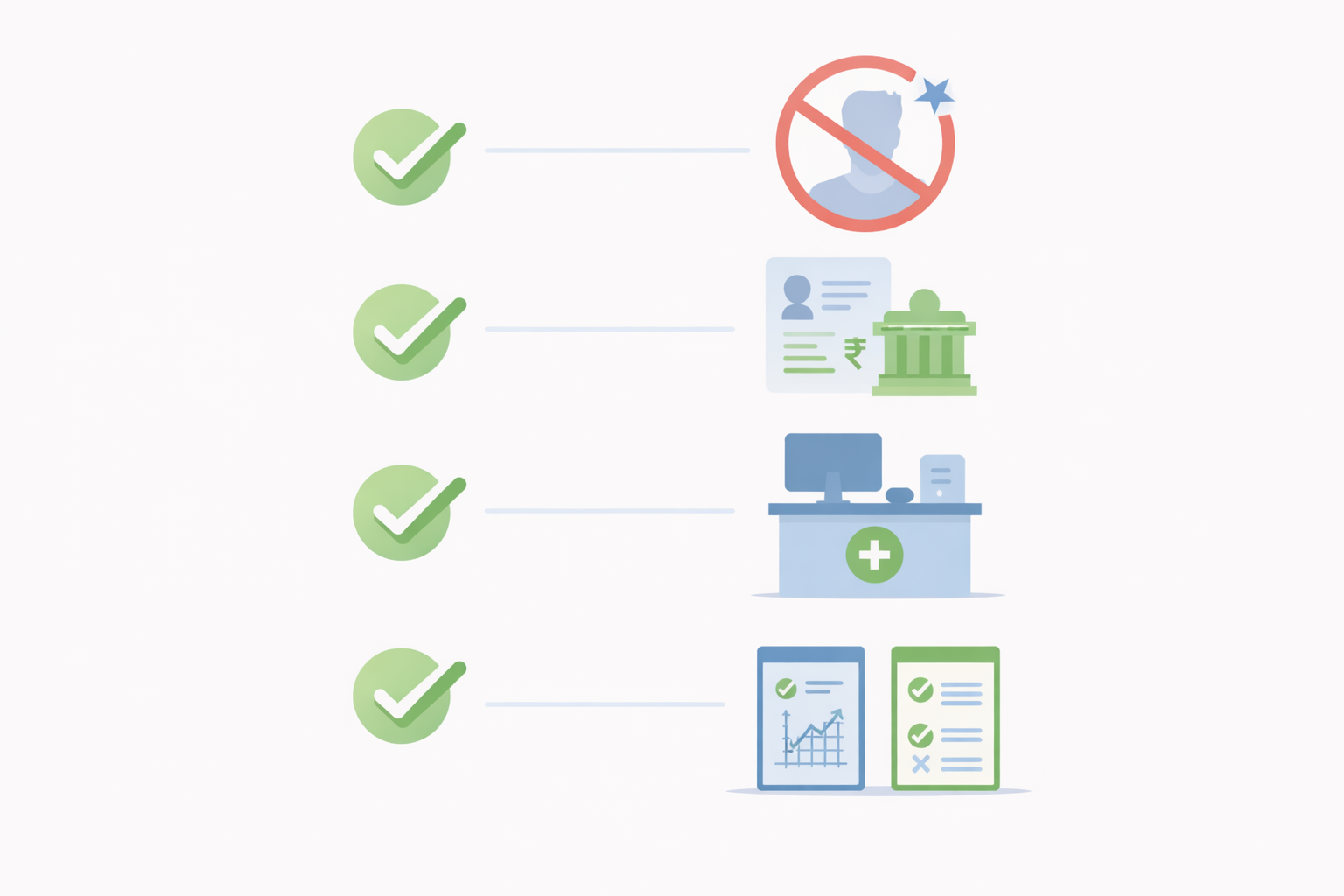

Here’s a quick checklist you can use — no expensive tools required:

- Ignore Celebrity Ads: Big marketing budgets don’t mean better claim experience.

- Check IRDAI Public Disclosures: Look for Form NL-37 to see how many claims were rejected and why.

- Ask Your Hospital’s Insurance Desk: The person who deals with claims daily has practical insights that most online charts don’t show.

- Compare CSR + ICR Together: One without the other paints an incomplete picture.

- Read Policy Wordings on Key Clauses: Especially things like room rent limits, pre-existing conditions, and waiting periods.

If you haven’t yet, check out our full guide on [Health Insurance Waiting Periods Explained] and [Room Rent Capping in Health Insurance] for deeper context.

Final Takeaway: Look for a Partner, Not Just a Percentage

In 2026, health insurance is becoming more customer-friendly overall. CSR is a useful number, but it should never be the only thing you consider.

When choosing a policy, prioritize:

- Coverage for modern treatments

- A large cashless hospital network

- Fast claims handling

- A stable history of both CSR and ICR

Because when life gets complicated, you want your insurer to be on your side — not just good on paper.

Frequently Asked Questions (Updated for 2026)

1. Is a 99% CSR always better than a 95% CSR?

Not necessarily. A 95% CSR with higher ICR and faster claim turnaround can be better in practice than a 99% company that delays or underpays claims.

2. Why do claims get rejected even if the CSR is high?

Most rejected claims are due to non-disclosure or missing documentation. Always be honest and thorough when declaring health history.

3. Does CSR matter for cashless claims?

Yes — even in cashless claims, the insurer still ultimately approves the payment. Insurers with low ratios might try to downgrade claims to reimbursement, making you pay upfront.

4. Where can I see health insurance CSR India statistics for free?

The IRDAI official website publishes public disclosures annually — it’s the most reliable source.

5. Should I change my insurer if their CSR drops?

Don’t panic over one anomalous year. But repeated decline across multiple years is a signal worth evaluating before your renewal.