If you’ve ever read a health insurance policy word by word (most people don’t, and that’s okay), you’ve probably come across a line called “Restoration of Benefits”. It sounds technical, maybe even fancy—but what does it actually do for you?

Simply put, the restoration of benefits clause in health insurance allows your policy to refill the sum insured after it gets used up during a policy year. Once restored, this amount can be used again for future hospitalisation claims, depending on the policy’s conditions.

In real life, this matters because medical bills in India can drain your entire cover faster than you expect—sometimes in just one hospital stay.

Why Do Health Insurance Policies Offer Restoration of Benefits?

Earlier, health insurance worked on a basic rule: once your sum insured was exhausted, your coverage stopped until the policy renewed. This left many people exposed, especially when:

- More than one family member needed hospitalisation

- A single illness required repeated admissions

- Treatment costs crossed the policy limit

To fix this gap, insurers introduced the restoration of benefits clause in health insurance—not as a bonus, but as a safety net. Over time, it became one of the most useful features in modern health insurance plans.

How Does the Restoration of Benefits Clause Work?

Let’s make this easy to understand with a practical example.

A Simple Example

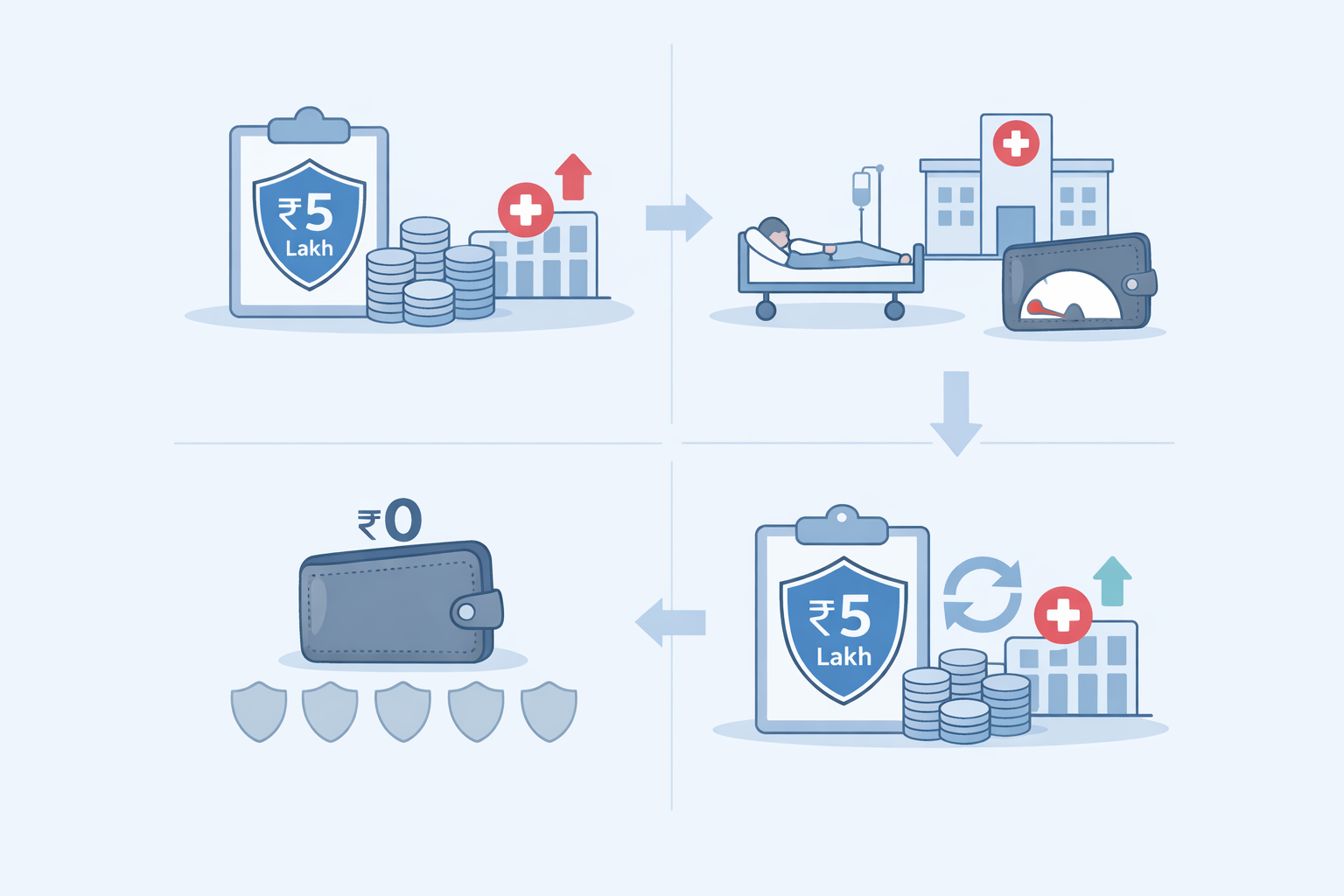

- Your base sum insured is ₹5 lakh

- You are hospitalised and claim the full ₹5 lakh

- Your available cover drops to zero

If your policy includes restoration of benefits, the insurer restores the ₹5 lakh sum insured. This means if another medical emergency happens in the same policy year, you still have coverage.

Sounds reassuring, right? But here’s the catch—restoration always comes with rules.

Different Types of Restoration of Benefits in Health Insurance

Not all restoration clauses are built the same. Knowing which type your policy offers makes a big difference at claim time.

1. Partial Restoration

Only the amount you used gets restored.

For example:

- Sum insured: ₹5 lakh

- Claim made: ₹3 lakh

- Restored amount: ₹3 lakh

This type is less common today but still exists in some older or basic plans.

2. Complete Restoration

The full sum insured is restored, even if you used only part of it. This version offers better protection and is now standard in many comprehensive policies.

3. Restoration Available Only Once a Year

Some policies allow restoration just once during the policy year. If the restored amount is also used up, there’s no further refill until renewal.

4. Multiple Restoration in a Single Year

More advanced health plans allow restoration multiple times within the same year. These are particularly useful for family floater policies and senior citizens.

Important Conditions You Should Always Check

This is where most misunderstandings happen. The restoration of benefits clause in health insurance may look generous, but the fine print matters.

Same Illness vs Different Illness

Some policies allow restoration only if the next claim is for a different illness. Others allow it even for the same illness.

If restoration works for the same illness, it’s generally a stronger feature.

Waiting Period for Restoration

Many insurers apply a waiting period (usually one or two years) before restoration benefits become active. This detail is often missed but very important.

Full Exhaustion Requirement

In several policies, restoration kicks in only after the base sum insured is fully used. Partial claims may not trigger restoration at all.

Individual vs Family Floater Plans

- In individual policies, restoration applies only to that person

- In family floater policies, the restored sum insured can be used by any covered family member

This is why restoration is especially valuable in family floater health insurance plans.

Restoration of Benefits vs No Claim Bonus (NCB)

These two features often get confused, but they serve very different purposes.

| Feature | Restoration of Benefits | No Claim Bonus |

|---|---|---|

| When it applies | After a claim | When no claim is made |

| Timeframe | Same policy year | Next policy year |

| Purpose | Backup protection | Reward for staying healthy |

A well-rounded policy usually offers both.

Is Restoration of Benefits Actually Useful?

Honestly—yes, but only when you see it for what it is.

Restoration is extremely helpful if:

- Your sum insured is modest

- You’re covering multiple family members

- You live in a city with high medical costs

That said, restoration should never replace an adequate base sum insured. A ₹5 lakh policy with restoration is still weaker than a ₹15 lakh policy without it.

Who Should Prioritise This Feature?

The restoration of benefits clause in health insurance is particularly important for:

- Families with elderly parents

- People managing diabetes, BP, or heart conditions

- Buyers of family floater policies

- Anyone worried about repeated hospitalisations

Common Myths Around Restoration of Benefits

Myth 1: Restoration Means Unlimited Coverage

It doesn’t. Restoration is always limited by policy conditions.

Myth 2: Restoration Works Automatically in Every Policy

Not true. Many policies require full exhaustion of the base sum insured first.

Myth 3: Restoration Makes High Coverage Unnecessary

Restoration is a backup—not a substitute for proper coverage.

What Regulators and Insurers Say

The Insurance Regulatory and Development Authority of India (IRDAI) requires insurers to clearly disclose restoration terms in policy documents. Still, the responsibility of understanding those terms lies with the buyer.

Reading insurer brochures and official policy wordings can save you from unpleasant surprises during claims.

What to Check Before Buying a Policy With Restoration

Before finalising your health insurance plan, ask yourself:

- Does restoration apply to the same illness?

- Is there a waiting period?

- Can it be used more than once a year?

- How does it work in a family floater?

If you’re still learning the basics of health insurance, you’ll find simple, jargon-free explanations on Finlopedia (https://www.finlopedia.com).

Final Thoughts

The restoration of benefits clause in health insurance isn’t a marketing gimmick—it’s a practical feature designed for real-world medical expenses.

While it can’t replace adequate coverage, it can act as a strong financial cushion when unexpected health issues strike more than once in a year.

Understanding how it works today can spare you confusion, stress, and financial strain tomorrow.

Frequently Asked Questions (FAQs)

1. What is the restoration of benefits clause in health insurance?

It is a feature that restores your sum insured after it is exhausted, allowing further claims in the same policy year.

2. Does restoration of benefits apply to the same illness?

That depends on the policy. Some insurers allow it, while others restrict it to different illnesses.

3. Is restoration available in the first year of the policy?

Often no. Many policies apply a waiting period before restoration becomes active.

4. Is restoration better than increasing the sum insured?

No. Increasing the base sum insured always provides stronger protection.

5. Is restoration useful in family floater health insurance?

Yes. It is especially useful when multiple family members may need hospitalisation in the same year.