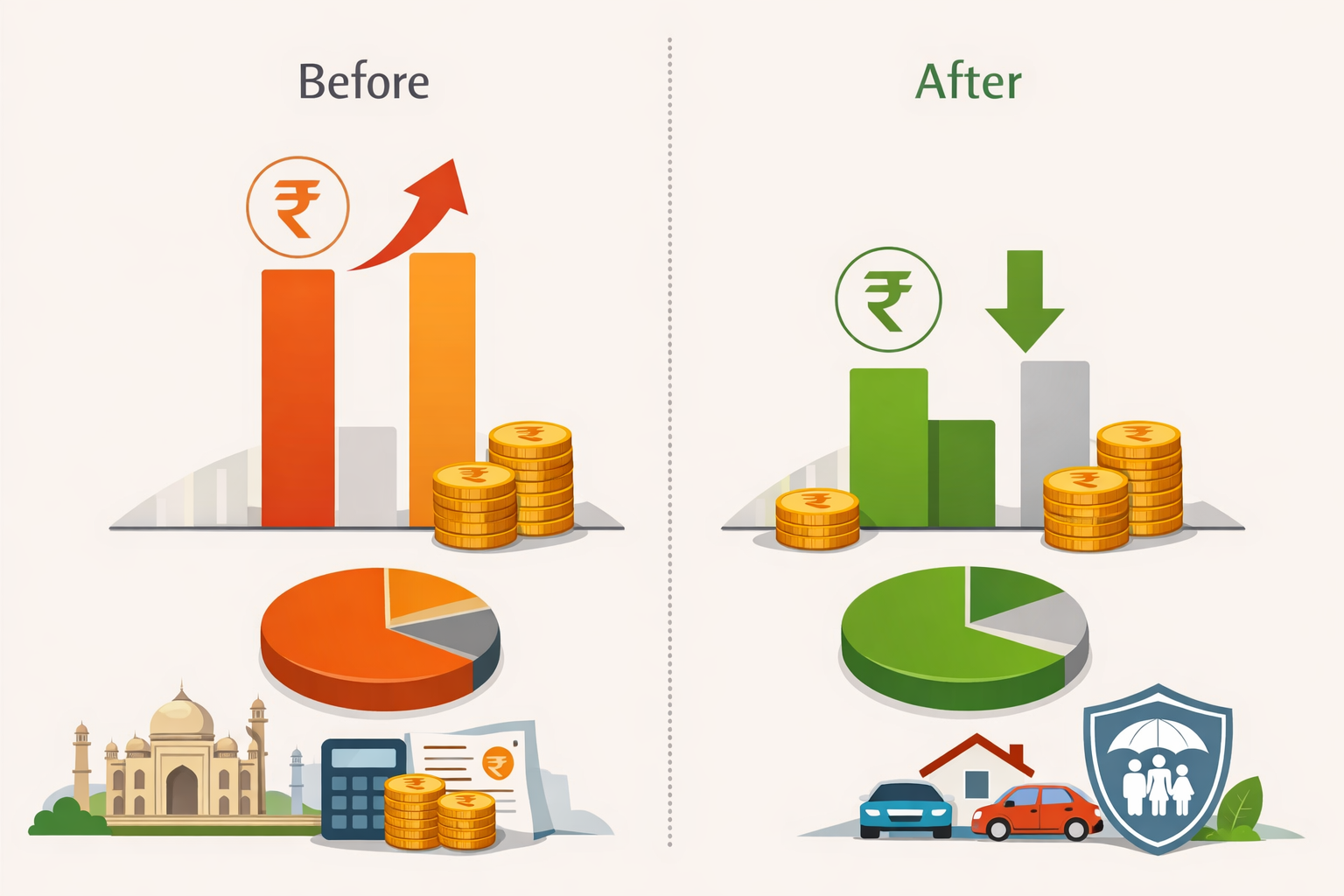

The insurance premium GST cut 2025 has quickly become one of the most discussed financial decisions in recent years. From September 22, 2025, the government removed the 18% Goods and Services Tax (GST) on individual health and life insurance premiums, including term insurance.

For many policyholders, this sounded like immediate relief. After all, insurance has been getting more expensive year after year, and an 18% tax removal feels significant on paper.

But here’s the real question most people are asking quietly:

Has insurance actually become cheaper, or does the benefit look better in headlines than on bills?

This article looks beyond the announcement to explain what really changed, who stands to benefit the most, and what the insurance premium GST cut 2025 means in practical terms for your money.

What Changed Under the Insurance premium GST Cut 2025?

Until September 2025, every individual buying health or life insurance paid 18% GST on their premium. This tax pushed up costs substantially, especially for families, senior citizens, and anyone renewing policies year after year.

Under the new rules:

- GST on individual health insurance premiums has been reduced to 0%

- GST on individual life and term insurance premiums is also 0%

- The change applies to new policies and renewals issued on or after September 22, 2025

- Group and corporate insurance policies are not covered under this exemption

The intent behind the insurance premium GST cut 2025 is straightforward — make insurance more affordable and encourage wider coverage, particularly among middle-income households that often delay buying protection because of cost.

How Much Can You Save After the GST Cut?

In simple terms, removing 18% GST should lead to noticeable savings.

Take a common example:

- Base premium: ₹20,000

- Earlier GST (18%): ₹3,600

- Total paid earlier: ₹23,600

After the insurance premium GST cut 2025, the same policy should ideally cost ₹20,000 — saving ₹3,600 every year.

Over 10–15 years, that difference alone can add up to a meaningful amount. This is exactly why many policyholders welcomed the reform as a major step forward.

However, once renewals started coming in, reality proved to be more complicated.

Why Savings May Be Lower Than Expected

The biggest reason actual savings don’t always match expectations lies in how GST works behind the scenes for insurers.

Earlier, insurance companies could claim Input Tax Credit (ITC) on expenses such as:

- Agent commissions

- Advertising and marketing

- Office rent and professional services

With the insurance premium GST cut 2025, insurance premiums are now GST-exempt, not zero-rated. That distinction matters. Exemption means insurers can no longer claim ITC on their operational costs, turning those taxes into direct expenses.

To manage this, insurers may:

- Slightly increase base premiums

- Cut back on commissions or operational costs

- Absorb part of the impact internally

This is why some policyholders are seeing only modest reductions — and in some cases, almost no visible change — despite GST being removed.

Health Insurance After the GST Cut

Health insurance was one of the biggest pain points for households even before the tax change. Medical inflation, higher hospital costs, and age-based premium increases have made renewals harder every year.

After the insurance premium GST cut 2025:

- Renewals issued after September 22 should not show GST

- Family floater plans may see noticeable relief if base premiums remain stable

- Senior citizen policies stand to benefit the most in absolute terms because their premiums are higher

That said, it’s important to compare renewal notices carefully. Don’t assume savings — check whether the base premium has changed.

Term and Life Insurance Impact

Term insurance is typically purchased for long durations, often 20 to 40 years. Even small differences in annual premiums matter over time.

Under the insurance premium GST cut 2025:

- Term insurance premiums no longer attract GST

- New buyers may find entry-level premiums slightly more affordable

- Existing policyholders should see GST removed at renewal

Still, insurers may rebalance pricing to offset lost tax credits, so a full 18% reduction should not be taken for granted.

What About Existing Policies?

If you already have a policy, the key factor is when it renews.

- Policies renewed before September 22, 2025: GST applied

- Policies renewed on or after September 22, 2025: GST removed

Always review your invoice. If GST is still charged on an eligible individual policy, it’s reasonable to ask your insurer for clarification.

Are Group and Employer Policies Included?

No. As of now, the insurance premium GST cut 2025 applies only to individual policies.

Group health insurance provided by employers and corporate covers continue to attract GST. This is important for salaried employees who rely solely on workplace insurance and assume all policies are treated equally.

Should You Buy Insurance Now?

Some buyers delayed purchases hoping the GST cut would significantly lower premiums. While tax relief helps, timing alone shouldn’t drive insurance decisions.

Keep these points in mind:

- Delaying coverage increases risk

- Base premiums can rise independently of tax changes

- Health conditions affect eligibility and pricing over time

If you genuinely need coverage, buying sooner is often the safer choice.

Government Intent vs Market Reality

From a policy standpoint, the insurance premium GST cut 2025 sends a strong signal about the government’s focus on financial security and wider insurance adoption.

However, experts highlight an important limitation: GST exemption is not the same as zero-rating. A zero-rated structure would have allowed insurers to retain input tax credits, likely resulting in clearer savings for consumers.

For now, how much you benefit depends largely on insurer pricing and market competition.

How to Maximise Your Benefit

To make the most of the insurance premium gst cut 2025:

- Compare premiums across multiple insurers

- Review renewal notices line by line

- Ask for clear, GST-free invoices

- Avoid policy lapses while waiting for marginal savings

Informed decisions matter more than tax changes alone.

Final Takeaway

The insurance premium GST cut 2025 is a welcome reform, but it isn’t a guaranteed 18% discount for everyone.

- GST on individual health and life insurance premiums has been removed

- Long-term affordability should improve gradually

- Actual savings depend on insurer pricing decisions

For policyholders, the real advantage lies in understanding the change, comparing options carefully, and choosing coverage based on need — not just tax headlines.

FAQs

1. What is the insurance premium GST cut 2025?

It refers to the removal of 18% GST on individual health and life insurance premiums from September 22, 2025.

2. Will my premium reduce by 18%?

Not necessarily. Savings depend on whether insurers pass on the benefit after losing input tax credits.

3. Does this apply to term insurance?

Yes, individual term and life insurance policies are included.

4. Are employer health policies covered?

No. Group and corporate policies are currently excluded.

5. How can I check if GST is removed from my policy?

Review your renewal invoice and confirm that no GST is charged.