Health insurance can often feel complex, especially when insurers use technical terms that are rarely explained in simple language. One such foundational concept is risk pooling. Understanding risk pooling in health insurance is crucial because it explains why premiums exist, how claims are paid, and why insurance works at all.

In this article, we’ll break down what is risk pooling in health insurance? Expect to learn also how it works, real-world examples, advantages, limitations, and why it matters for policyholders in India.

What Is Risk Pooling in Health Insurance?

Risk pooling in health insurance is a system where a large group of people contribute premiums into a common pool, which is then used to pay for the medical expenses of members who fall ill or require treatment.

Instead of one individual bearing the full cost of hospitalization or medical care, the financial risk is shared among all insured members.

In simple terms:

Many people pay a small amount so that a few people can receive large financial support when needed.

Why Risk Pooling Is the Core of Health Insurance

Health insurance would not be financially viable without risk pooling. Medical emergencies are unpredictable and often expensive. If people had to pay out-of-pocket every time, healthcare would be unaffordable for most households.

Risk pooling allows:

- Predictable premium pricing

- Affordable healthcare access

- Financial protection during emergencies

- Stability for insurance companies

This concept is the backbone of all insurance products — not just health insurance, but life, motor, and general insurance as well.

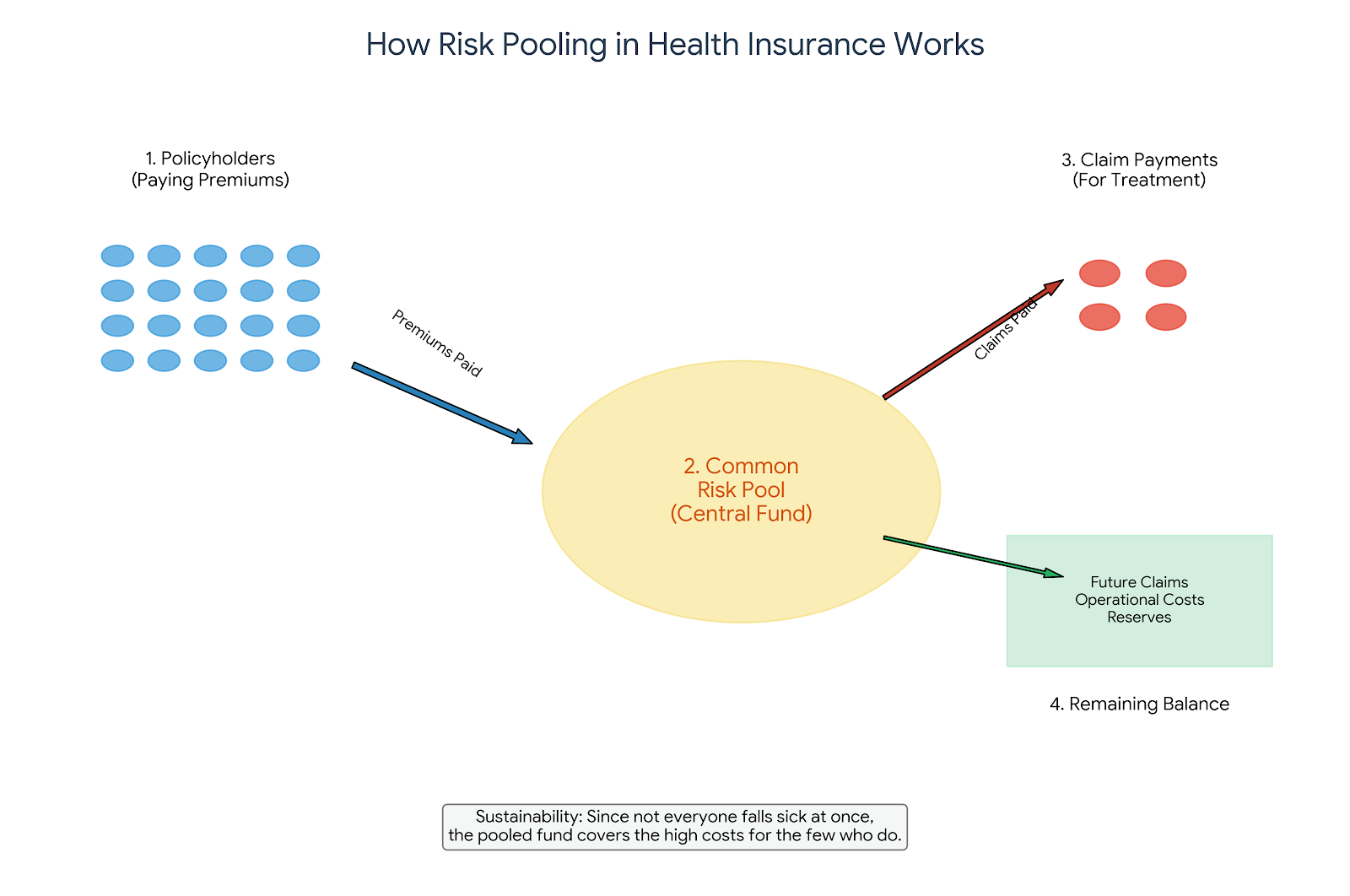

How Risk Pooling in Health Insurance Works

Let’s understand the mechanism step by step:

1. Collection of Premiums

Thousands or even lakhs of policyholders pay premiums regularly to the insurer.

2. Creation of a Common Risk Pool

All collected premiums are accumulated into a single fund called the risk pool.

3. Claim Payments

When some policyholders need medical treatment or hospitalization, claim payments are made from this pooled fund.

4. Remaining Balance

The remaining funds are used to cover future claims, operational costs, and regulatory reserves.

Since not everyone falls sick at the same time, the pool remains sustainable.

A Simple Example of Risk Pooling

Imagine 10,000 people buy a health insurance policy with an annual premium of ₹10,000.

- Total premium collected = ₹10 crore

- Only 1,500 people require hospitalization in that year

- Average claim cost = ₹1 lakh

Total claims paid = ₹15 crore

The shortfall or surplus is managed using:

- Previous years’ reserves

- Premium pricing adjustments

- Reinsurance arrangements

This example shows how collective contribution protects individuals from massive expenses.

(Our article here about how health insurance companies make money might help you understand the concept better.)

Types of Risk Pooling in Health Insurance

Risk pooling can vary depending on the structure of the insurance system.

1. Individual Health Insurance Pools

Each insurer maintains its own pool of individual policyholders. Premiums are based on:

- Age

- Medical history

- Lifestyle risks

2. Group Health Insurance Pools

Corporate or employer-provided health plans use group risk pooling, where:

- Health risks are spread across employees

- Premiums are lower due to large pool size

- Medical underwriting is limited

3. Government-Sponsored Risk Pools

Schemes like Ayushman Bharat use nationwide risk pooling to provide coverage to economically vulnerable populations.

Why Risk Pooling Reduces Health Insurance Premiums

The larger and more diverse the pool, the lower the risk for insurers. This directly impacts premium pricing.

Benefits of larger risk pools:

- Lower claim volatility

- Better predictability

- Reduced premium hikes

- Inclusion of high-risk individuals

This is why group health insurance plans are often cheaper than individual policies. (This will help if you are a first time buyer)

Risk Pooling vs Risk Sharing: Key Differences

Although often confused, these two concepts are different.

| Aspect | Risk Pooling | Risk Sharing |

|---|---|---|

| Definition | Collective collection of premiums | Cost-sharing between insurer and insured |

| Examples | Premium pool | Deductibles, copay, co-insurance |

| Purpose | Spread financial risk | Reduce overutilization |

| Who bears risk | Entire insured group | Individual policyholder |

Advantages of Risk Pooling in Health Insurance

1. Financial Protection

Risk pooling prevents catastrophic medical expenses from wiping out personal savings.

2. Affordable Healthcare

People can access quality healthcare without worrying about full costs upfront.

3. Inclusion of High-Risk Individuals

Elderly people and those with pre-existing diseases benefit from shared risk.

4. Predictable Healthcare Costs

Premiums are fixed and predictable compared to uncertain medical bills.

5. Encourages Preventive Care

With insurance coverage, people are more likely to seek early treatment.

Limitations and Challenges of Risk Pooling

Despite its benefits, risk pooling has some challenges.

1. Adverse Selection

If mostly sick individuals buy insurance, the pool becomes unbalanced, leading to higher premiums.

2. Moral Hazard

People may overuse medical services because they are insured.

3. Rising Healthcare Costs

Inflation in healthcare costs increases pressure on risk pools.

4. Premium Increases

Poor claim experience in a pool may lead to higher premiums for everyone.

Insurers manage these risks using underwriting, waiting periods, and co-payment clauses.

Risk Pooling in Health Insurance in India

In India, risk pooling plays a crucial role due to:

- High out-of-pocket healthcare expenses

- Limited insurance penetration

- Rising medical inflation

Both private insurers and government schemes rely heavily on risk pooling to offer coverage at scale.

According to the Insurance Regulatory and Development Authority of India (IRDAI), effective risk pooling is essential for long-term sustainability of health insurance systems.

For a broader understanding of how health insurance works in India, you can also refer to this WHO explainer on health financing and pooling mechanisms.

Why Risk Pooling Matters for Policyholders

As a policyholder, understanding risk pooling helps you:

- Appreciate why premiums are structured the way they are

- Understand why claims may affect future premiums

- Make informed decisions when choosing group vs individual plans

It also explains why continuous coverage and early enrollment are beneficial.

How Insurers Strengthen Risk Pools

Insurance companies actively work to maintain healthy risk pools by:

- Encouraging young policyholders

- Offering wellness programs

- Using medical underwriting

- Partnering with hospitals for cost control

- Purchasing reinsurance

These measures ensure that the pool remains financially viable over the long term.

Risk Pooling and the Future of Health Insurance

With the rise of:

- Digital health records

- AI-based underwriting

- Preventive healthcare programs

Risk pooling is becoming more efficient and data-driven. Insurers can now predict claims better, reduce fraud, and price premiums more accurately.

However, the fundamental principle remains unchanged — shared risk equals shared protection.

Final Thoughts

Risk pooling is the foundation of health insurance, not just a technical concept. It represents collective responsibility and financial solidarity. By spreading healthcare costs across a large group, risk pooling ensures that no individual is left financially vulnerable during medical emergencies.

For anyone buying or already holding health insurance, understanding risk pooling leads to smarter decisions, realistic expectations, and better long-term financial planning.

Frequently Asked Questions (FAQs)

1. What is risk pooling in simple words?

Risk pooling means collecting money from many people to pay medical bills for those who need treatment.

2. Why is risk pooling important in health insurance?

It makes healthcare affordable and protects individuals from high medical expenses.

3. Does risk pooling increase premiums?

No, larger and healthier risk pools generally help keep premiums stable or lower.

4. Is risk pooling used in government health schemes?

Yes, most government health insurance schemes rely heavily on nationwide risk pooling.

5. Can risk pooling fail?

It can become inefficient due to adverse selection, fraud, or uncontrolled healthcare inflation, but insurers actively manage these risks.