Buying health insurance can feel like a maze. Most of us focus on coverage amounts, hospital networks, or premium costs, but health insurance exclusions are often ignored — until you file a claim and realize certain treatments or conditions aren’t covered.

In this guide, we’ll explain what these exclusions are, why insurers include them, common types, and how to make sure you’re not caught off guard.

1. What Are Health Insurance Exclusions?

Simply put, health insurance exclusions are things your policy won’t cover. They are usually listed in a section of your policy document and can include specific illnesses, treatments, or even circumstances like adventure sports injuries.

If a claim falls under an exclusion, your insurer can say no — which is why it’s important to know them inside out.

Tip: For a quick overview of health insurance basics, check out Finlopedia’s this article.

2. Why Do Health Insurance Policies Have Exclusions?

You might wonder, “Why would an insurer refuse to cover some conditions when I’ve been paying premiums for years?”

Here’s why:

- Keeping premiums manageable – Insurers exclude certain high-risk or predictable costs to avoid making premiums too expensive for everyone.

- Preventing misuse – Without exclusions, someone could buy insurance just to cover an expensive upcoming surgery.

- Actuarial fairness – Insurance is calculated based on risk. Exclusions help companies stay financially stable.

- Legal or regulatory reasons – Some exclusions are mandated by law.

Think of exclusions as the fine print that keeps the system fair and sustainable. (Aditya Birla Capital)

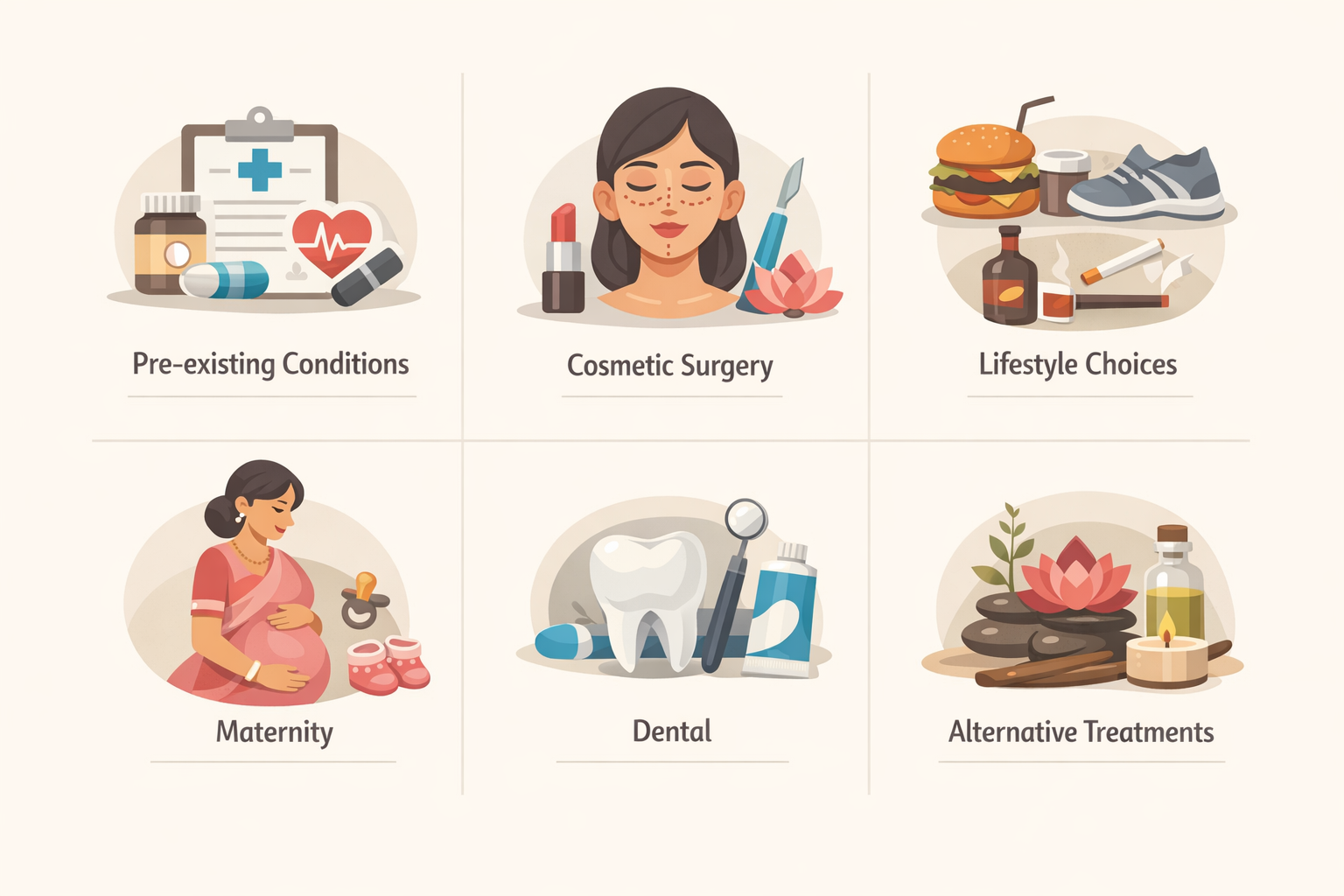

3. Common Types of Health Insurance Exclusions

Here’s a breakdown of what you’re most likely to see excluded:

A. Pre‑Existing Conditions

If you already had an illness before buying your policy, it may be excluded for a waiting period — sometimes 2–4 years. Examples include diabetes, asthma, or heart disease.

💡 In some countries, like the US after the Affordable Care Act, insurers can’t exclude pre-existing conditions. (Wikipedia)

B. Cosmetic & Elective Procedures

Treatments purely for looks — like cosmetic surgery, hair transplants, or liposuction — are usually excluded. Only if a procedure is medically necessary (like reconstructive surgery after an accident) will it be covered. (Acko)

C. Lifestyle & Substance-Related Exclusions

Conditions caused by habits like smoking, alcohol misuse, or drug use are often excluded. For example, liver damage due to alcoholism may not be covered.

D. Maternity, Newborn & Fertility Treatments

Most standard health plans don’t include maternity, childbirth, or fertility treatments like IVF unless you add a special rider.

E. Routine Dental, Vision & Hearing

Regular dental check-ups, glasses, and hearing aids are generally not included unless linked to hospitalisation or added as a rider.

F. Alternative & Experimental Treatments

Treatments like acupuncture, naturopathy, or new experimental drugs often aren’t covered because they’re not fully validated or standardized.

G. Other Exclusions

Some common additional exclusions:

- Outpatient treatments (OPD) without hospitalisation

- Adventure or high-risk sports injuries

- War, riots, or nuclear events

- Routine checkups

Always read the exclusions list carefully — no two policies are exactly the same. (General Insurance Studio)

4. How Exclusions Affect Your Insurance Claim

Many people are shocked when their claims get denied — often because the treatment falls under an exclusion.

For example, if you’re admitted for alcohol-related pancreatitis, your insurer may refuse the claim. That said, other treatments during the same hospital stay might still be covered if they aren’t excluded.

Understanding exclusions upfront helps you avoid surprise bills.

5. Can You Reduce or Avoid Exclusions?

Yes! Here’s how:

- Add Riders – Many insurers let you buy maternity, dental, or critical illness riders to cover excluded items.

- Choose a comprehensive policy – Comprehensive plans usually have fewer exclusions and shorter waiting periods.

- Read your policy carefully – Don’t rely on verbal explanations alone. Know what’s excluded before signing.

6. How to Read Your Policy Like a Pro

- Find the Exclusions section in your policy

- Check waiting periods for specific illnesses

- Note lifetime limits or caps

- Pay attention to exclusions that matter for your personal health history

- Ask your insurer for clarification if anything is unclear

7. Helpful Resources on Finlopedia

To understand health insurance better, these Finlopedia articles can help:

- How to Choose the Right Health Insurance Plan

- Health Insurance Riders Explained

- Pre-Existing Conditions & Waiting Periods

8. FAQs About Health Insurance Exclusions

Q1: What are health insurance exclusions?

A: Conditions, treatments, or situations that your policy doesn’t cover.

Q2: Why do insurers exclude certain conditions?

A: To manage risk, keep premiums reasonable, prevent misuse, and stay financially stable.

Q3: Are pre-existing conditions always excluded?

A: Not always — it depends on the policy and country regulations. Waiting periods may apply.

Q4: Can I challenge an exclusion?

A: Yes. You can appeal with your insurer or regulator if you feel it was applied incorrectly.

Q5: How can I reduce the impact of exclusions?

A: Add riders, choose comprehensive plans, and review policy terms before buying.