Filling out a health insurance form can feel stressful when you live with depression. That single question about pre-existing conditions carries a lot of weight. You’re not just declaring a medical history—you’re trying to figure out whether the system will actually support you.

So let’s answer this clearly and honestly: Can I get health insurance if I have depression as a pre-existing condition?

Yes, you can. But the details matter. This guide explains exactly how health insurance works for depression in India in 2026—what insurers are legally required to cover, what waiting periods apply, how premiums are affected, and how to apply without risking claim rejection.

The Short Answer

Can I get health insurance if I have depression as a pre-existing condition? Yes. Indian insurers are legally required to offer coverage for mental illness, including depression.

This is because of:

- The Mental Healthcare Act, 2017

- IRDAI circulars issued between 2022 and 2024

Mental illness must now be treated on par with physical illness in health insurance policies. That means insurers cannot reject you just because you have depression.

However, having depression as a pre-existing condition does affect waiting periods, premiums, and how soon claims are paid.

What Counts as Pre-Existing Depression?

Under IRDAI rules, a pre-existing disease (PED) is any condition that was diagnosed, treated, or showed symptoms in the 48 months before you buy the policy.

Depression is considered pre-existing if:

- You were diagnosed within the last 4 years

- You are currently on antidepressants

- You’ve been seeing a psychiatrist or therapist

- You had a mental health–related hospitalization

In these cases, insurers will still issue a policy—but with conditions attached.

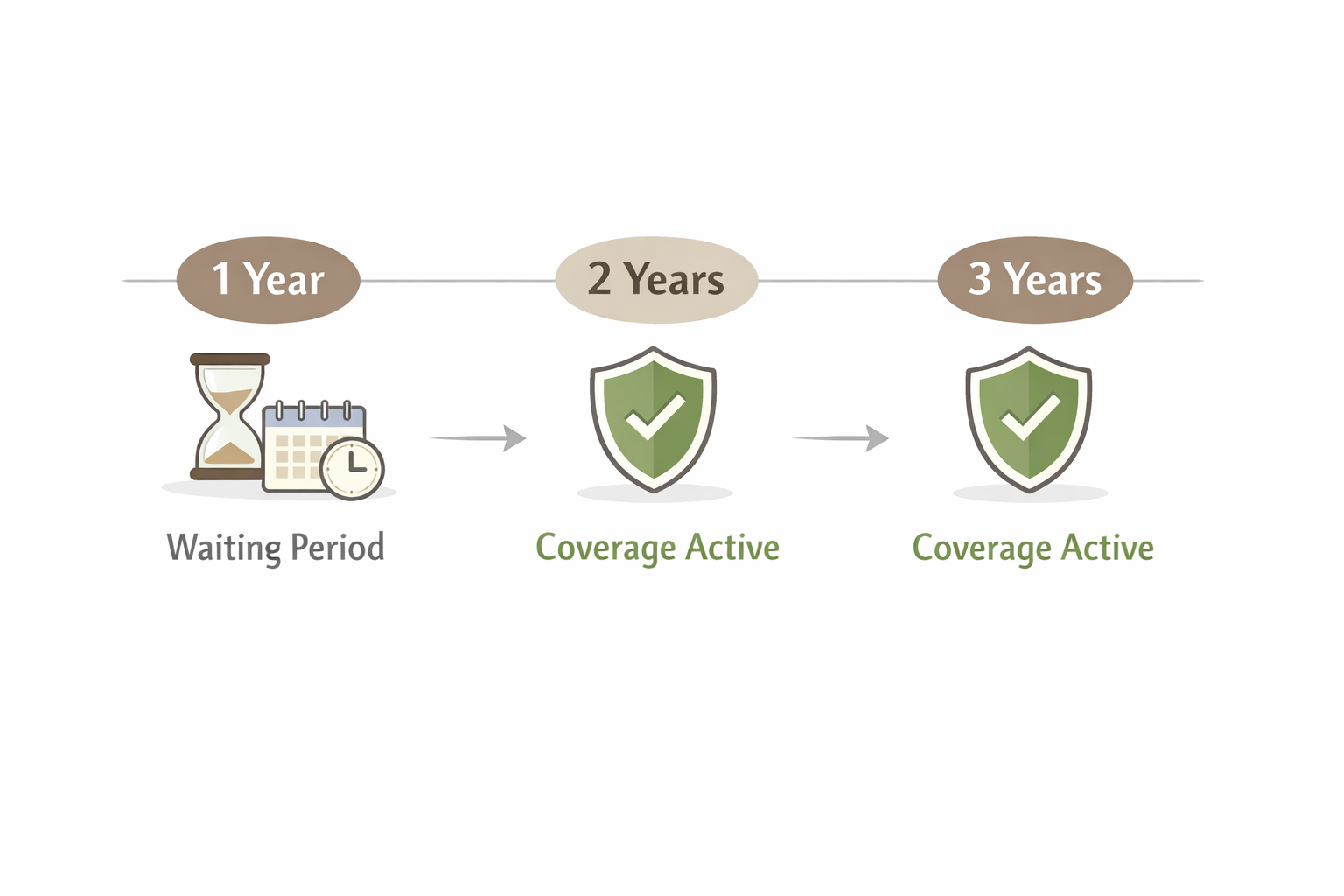

Waiting Period: When Does Coverage Actually Start?

When you disclose depression, insurers apply a waiting period before they cover depression-related claims.

Typical waiting periods:

- 1 year (select plans or buy-back options)

- 2 years (common)

- Up to 3 years (maximum allowed by IRDAI)

During the waiting period:

- Hospitalization for depression is not covered

- Psychiatric emergencies related to depression are not covered

After the waiting period:

- Inpatient psychiatric treatment becomes claimable

- Coverage works like it does for any other illness

This waiting period applies only to depression-related treatment. Claims for unrelated conditions are covered immediately.

Can I Get Health Insurance If I Have Depression as a Pre-Existing Condition Without a Waiting Period?

Yes, in limited cases.

Some insurers offer:

- Zero waiting period plans, or

- PED waiting-period waiver add-ons

If you choose this route:

- Premiums are significantly higher

- Full medical disclosure is mandatory

These plans make sense if you’re at high risk of hospitalization and want immediate protection.

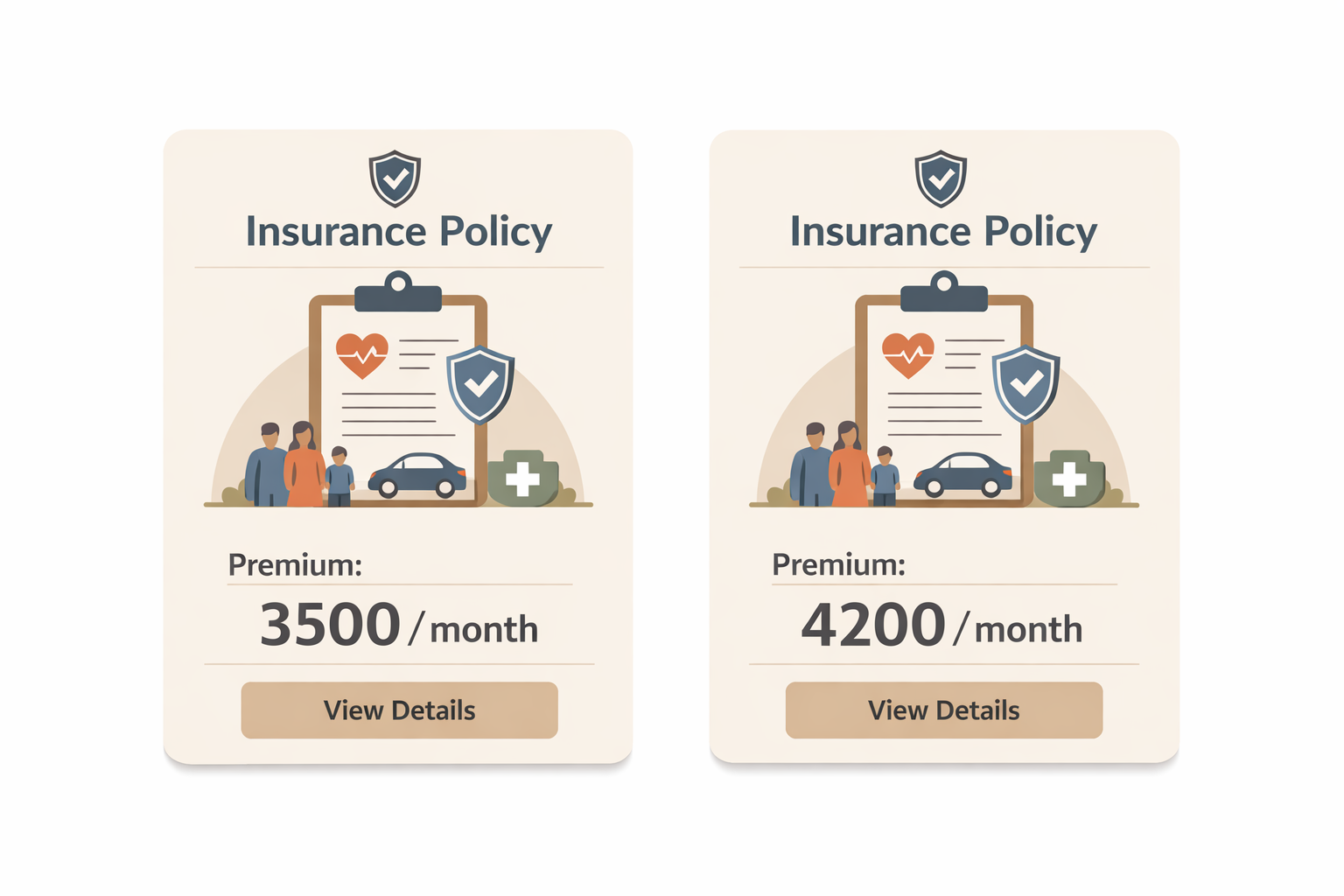

How Depression Affects Your Premium

Most insurers apply premium loading when you disclose depression.

Typical loading ranges:

- 20–40% for mild or stable depression

- 40–70% for severe cases or recent hospitalization

Example:

If a ₹5 lakh policy normally costs ₹15,000/year, you may pay ₹18,000–₹25,000 for the same coverage.

The loading is based on:

- Severity of symptoms

- Treatment stability

- Medication history

- Time since diagnosis

While higher premiums feel unfair, they are still far cheaper than paying for psychiatric hospitalization out of pocket.

What Is Actually Covered?

Once the waiting period ends, insurers must cover inpatient mental health treatment.

Covered

- Psychiatric hospitalization

- Doctor consultations during admission

- Medications administered in hospital

Limited or Optional

- Therapy and counseling (usually via OPD add-ons)

- Outpatient psychiatrist visits

Common Exclusions

- Routine counseling without OPD cover

- Substance abuse treatment

- Suicide or self-harm attempts

Most policies still focus on hospitalization. If therapy coverage matters to you, look specifically for OPD mental health benefits.

Is Psychiatrist Consultation and Therapy Covered by Health Insurance?

This is one of the most misunderstood parts of mental health coverage in India.

Psychiatrist visits and therapy are not automatically covered under most standard health insurance policies.

Here’s how it works in practice:

Inpatient Psychiatric Treatment

If you are hospitalized for depression after the waiting period:

-

Psychiatrist consultations during admission are covered

-

Medicines administered in the hospital are covered

-

Room rent and related hospital expenses are covered

This coverage is mandatory under Indian law.

Outpatient Psychiatrist Visits and Therapy

Regular psychiatrist consultations, therapy sessions, and counseling are considered outpatient (OPD) care.

These are covered only if:

-

Your policy includes an OPD mental health add-on, or

-

Your insurer offers a specific mental health OPD benefit

Without OPD coverage:

-

Therapy sessions are paid out of pocket

-

Routine follow-ups with a psychiatrist are not reimbursed

Why insurers limit therapy coverage

Health insurance in India is still primarily designed for hospitalization, not long-term therapy. While laws mandate parity for mental illness, insurers are allowed to:

-

Cap OPD benefits

-

Restrict the number of therapy sessions

-

Apply sub-limits on mental health OPD claims

What to check before buying

If therapy access matters to you, check:

-

Whether OPD mental health is included

-

Annual limits on therapy sessions

-

Co-payment requirements

-

Network providers vs reimbursement

For many people with depression, combining health insurance for hospitalization with a separate therapy budget is still the most realistic approach.

The Disclosure Question: Be Honest or Not?

Some people wonder whether hiding depression might make things easier.

It won’t.

If you don’t disclose depression:

- Claims can be rejected for misrepresentation

- The policy can be cancelled

- All premiums paid can be forfeited

Insurers verify medical history during claims through prescriptions, hospital records, and doctor reports. Non-disclosure almost always backfires.

If you’re asking can I get health insurance if I have depression as a pre-existing condition, the safest and smartest answer always involves full disclosure.

How to Apply Safely (Step-by-Step)

- Collect medical records

Diagnosis notes, prescriptions, discharge summaries - Compare insurers

Look for shorter waiting periods and mental health inclusion - Disclose honestly

Diagnosis date, medication, therapy history - Undergo underwriting

Some insurers may request a fresh psychiatric opinion - Review the offer

Check waiting period, exclusions, and premium loading before buying

Common Myths

- “I’ll be rejected outright.” → False

- “Mental health is only covered on paper.” → Coverage is real after waiting periods

- “Employer insurance means no disclosure.” → Wrong; claims can still be denied

- “Higher premium means better coverage.” → Not always—check policy wording

Bottom Line

Can I get health insurance if I have depression as a pre-existing condition? Yes.

But expect:

- Mandatory disclosure

- A waiting period (usually 1–3 years)

- Higher premiums

What you get in return is real, enforceable coverage when you need it most.

Mental health insurance in India has improved significantly since 2022. It’s not perfect, but going uninsured is far riskier than navigating waiting periods and premiums.

Make the decision calmly, compare policies carefully, and choose protection that actually works for you.

FAQs

1. Can I get insured if I’m currently on antidepressants?

Yes. Medication does not disqualify you, but it must be disclosed.

2. Is depression treated differently from physical illness?

Legally, no. Waiting periods and coverage rules apply similarly.

3. Will therapy be covered?

Only if the policy includes OPD mental health benefits.

4. What if I don’t disclose depression?

Claims can be rejected and the policy cancelled.

5. Is it worth paying a higher premium?

For many people, yes—especially if hospitalization risk exists.