Healthcare in India is no longer limited to hospitals, injections, and surgeries alone. A growing number of people now trust traditional systems like Ayurveda, Homeopathy, Unani, and Yoga for both treatment and long-term wellness. Naturally, this shift has raised an important question for policyholders: does health insurance cover AYUSH treatment?

The short answer is yes. AYUSH health insurance in India is real, regulated, and increasingly common — but it comes with conditions, rules, and limitations that most people don’t fully understand.

This article breaks it all down in simple, human language. No jargon. No sales pitch. Just clear answers.

What Exactly Is AYUSH Treatment?

AYUSH is an umbrella term used by the Government of India for five traditional medical systems:

- Ayurveda – herbal medicines, therapies, detox procedures, and lifestyle correction

- Yoga & Naturopathy – natural healing, body balance, and preventive care

- Unani – treatment based on body temperament and balance

- Siddha – ancient South Indian system focused on chronic diseases

- Homeopathy – individualized treatment using diluted natural substances

These are not alternative or unregulated practices. They are officially recognized, regulated, and taught in certified institutions across India.

Because of this recognition, insurance coverage for AYUSH treatments has gradually become part of mainstream health insurance policies.

Is AYUSH Health Insurance in India Really Covered?

Yes — but only under specific conditions.

Most health insurance policies in India now include AYUSH coverage, either:

- As part of the base policy, or

- As a clearly mentioned benefit or add-on

However, AYUSH insurance does not work exactly like regular allopathic coverage.

What Does AYUSH Health Insurance Actually Cover?

1. Hospitalization Is Mandatory

AYUSH health insurance in India primarily covers in-patient hospitalization.

This means:

- You must be admitted to the hospital

- The treatment usually requires 24 hours or more

- Day visits, consultations, or casual therapy sessions are not enough

If you’re simply visiting an Ayurvedic doctor or taking Homeopathy medicines at home, insurance will not apply.

2. Only Recognized Hospitals Are Allowed

This is where many claims fail.

AYUSH treatment is covered only if it is taken at:

- A government-recognized AYUSH hospital, or

- A hospital accredited by NABH / QCI, or

- A hospital approved by your insurer’s network

Private clinics, wellness resorts, yoga retreats, and spa-style Panchakarma centres are usually not eligible, even if doctors are qualified.

3. What Expenses Are Covered?

During eligible hospitalization, insurance may cover:

- Room rent and nursing charges

- Doctor’s consultation and supervision

- Medicines prescribed during treatment

- Therapies and procedures performed during admission

- Diagnostic tests required for treatment

In short, if the expense is medically necessary and part of hospitalization, it is usually covered.

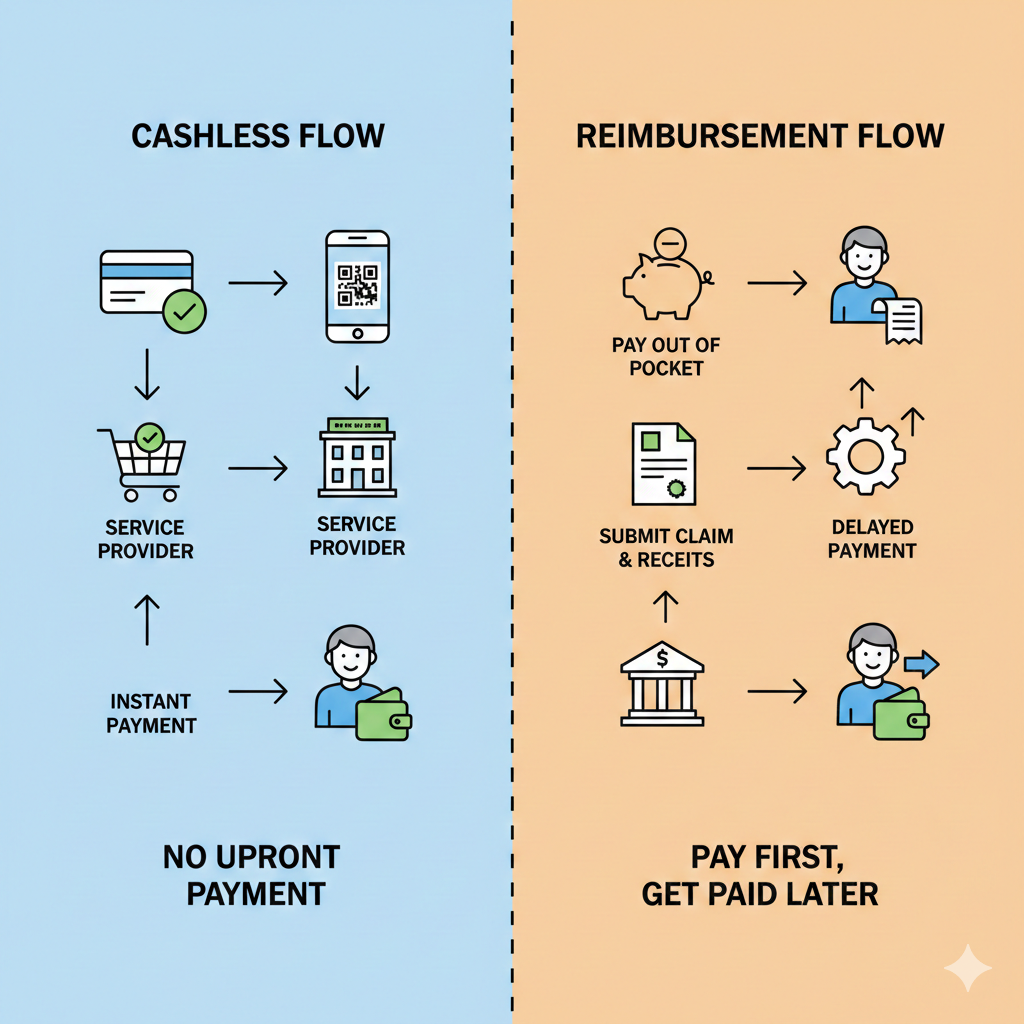

Cashless vs Reimbursement: How Claims Work

Cashless AYUSH Treatment

If the AYUSH hospital is part of your insurer’s network:

- You can opt for cashless treatment

- The hospital coordinates directly with the insurer

- You only pay for non-covered items, if any

Reimbursement Claims

If the hospital is not in the network:

- You pay the bills upfront

- Submit documents after discharge

- Insurer reimburses approved expenses

Proper documentation is critical in both cases.

What Is Usually NOT Covered Under AYUSH Insurance?

This is where expectations need to be realistic.

Most policies do not cover:

- OPD consultations

- Routine doctor visits

- Yoga classes or wellness programs

- Preventive or rejuvenation therapies

- Treatments taken without hospitalization

Unless your policy specifically mentions OPD or wellness benefits, assume they are excluded.

IRDAI Rules on AYUSH Health Insurance in India

The Insurance Regulatory and Development Authority of India (IRDAI) has made it clear that:

- AYUSH treatment must be offered by insurers

- Coverage should be at par with allopathic treatment, subject to policy terms

- Insurers cannot arbitrarily deny AYUSH claims if conditions are met

This has significantly improved claim acceptance and policy clarity in recent years.

Why AYUSH Health Insurance Actually Makes Sense

1. Rising Trust in Traditional Medicine

Many chronic conditions — like arthritis, digestive disorders, skin issues, and lifestyle diseases — are increasingly treated through AYUSH systems.

Insurance support makes these treatments financially accessible.

2. Lower Treatment Costs, Longer Care

AYUSH treatments often require longer hospital stays but cost less than surgeries or intensive care. Insurance helps cover these extended stays without financial stress.

3. Choice and Flexibility

AYUSH health insurance in India gives policyholders freedom of choice — you’re not forced into one system of medicine.

Common Mistakes That Lead to Claim Rejection

- Getting treated at non-recognized centres

- Assuming OPD treatment is covered

- Missing discharge summaries or prescriptions

- Not informing the insurer before hospitalization

- Mixing wellness therapy with medical treatment

Most rejections happen due to technical mistakes, not because AYUSH is excluded.

How to Choose a Policy With Good AYUSH Coverage

Before buying or renewing your policy, check:

- Does the policy explicitly mention AYUSH coverage?

- Are there any sub-limits?

- Is cashless AYUSH treatment available?

- Are hospitals in your city empanelled?

- What is the insurer’s claim settlement ratio?

Always read the policy wording — not just the brochure.

The Future of AYUSH Health Insurance in India

AYUSH coverage is no longer a “nice extra”. It is becoming a standard expectation.

In the coming years, we’re likely to see:

- Wider hospital networks

- Limited OPD AYUSH coverage

- Clearer claim rules

- More awareness among policyholders

Traditional medicine is no longer on the sidelines — and insurance is finally catching up.

Final Takeaway

AYUSH health insurance in India is not a loophole or a marketing gimmick — it is a legitimate, regulated benefit. But it works only when you understand the rules.

If you choose the right policy, the right hospital, and follow the claim process properly, AYUSH insurance can quietly become one of the most valuable features of your health cover.

FAQs: AYUSH Health Insurance in India

1. Is AYUSH treatment covered under all health insurance policies?

Most modern policies cover AYUSH hospitalization, but coverage depends on policy terms and hospital eligibility.

2. Can I get cashless AYUSH treatment?

Yes, if the hospital is part of the insurer’s network and meets accreditation requirements.

3. Are AYUSH medicines covered by insurance?

Medicines prescribed during hospitalization are usually covered. OPD medicines are not.

4. Does AYUSH insurance cover yoga and wellness therapies?

Only if they are part of a medically necessary hospitalization. Wellness programs alone are not covered.

5. Is AYUSH coverage allowed by IRDAI?

Yes. IRDAI has clearly allowed and regulated AYUSH health insurance in India.