Choosing between health insurance and mediclaim is one of the most common confusions among Indian buyers. Many people use these terms interchangeably, but they are not the same. Understanding the difference between health insurance and mediclaim is crucial if you want adequate coverage, long-term protection, and value for money.

In this detailed guide, we’ll break down health insurance vs mediclaim, compare benefits, coverage, limitations, and help you decide which one is better: health insurance or mediclaim?

Understanding the Basics: Health Insurance vs Mediclaim

Before comparing which one is better, let’s understand what each actually means.

What Is Mediclaim?

Mediclaim is a basic health insurance policy that primarily covers hospitalization expenses due to illness or accident. It has limited scope and usually reimburses only in-patient medical costs.

Key features of mediclaim:

- Covers hospitalization expenses only

- Fixed sum insured

- Lower premium

- Limited add-ons

- Often sub-limits on room rent and treatments

Mediclaim policies were among the earliest health covers in India, which is why the term is still widely used.

What Is Health Insurance?

Health insurance is a comprehensive medical cover that includes hospitalization, pre- and post-hospitalization, daycare procedures, ambulance charges, critical illness cover, wellness benefits, and more.

Key features of health insurance:

- Broader coverage

- Higher sum insured options

- Cashless treatment

- No-claim bonus

- Customizable riders

- Lifetime renewability

In short, all mediclaim policies are health insurance, but not all health insurance policies are mediclaim. (our article here will help if you are looking to buy an health insurance)

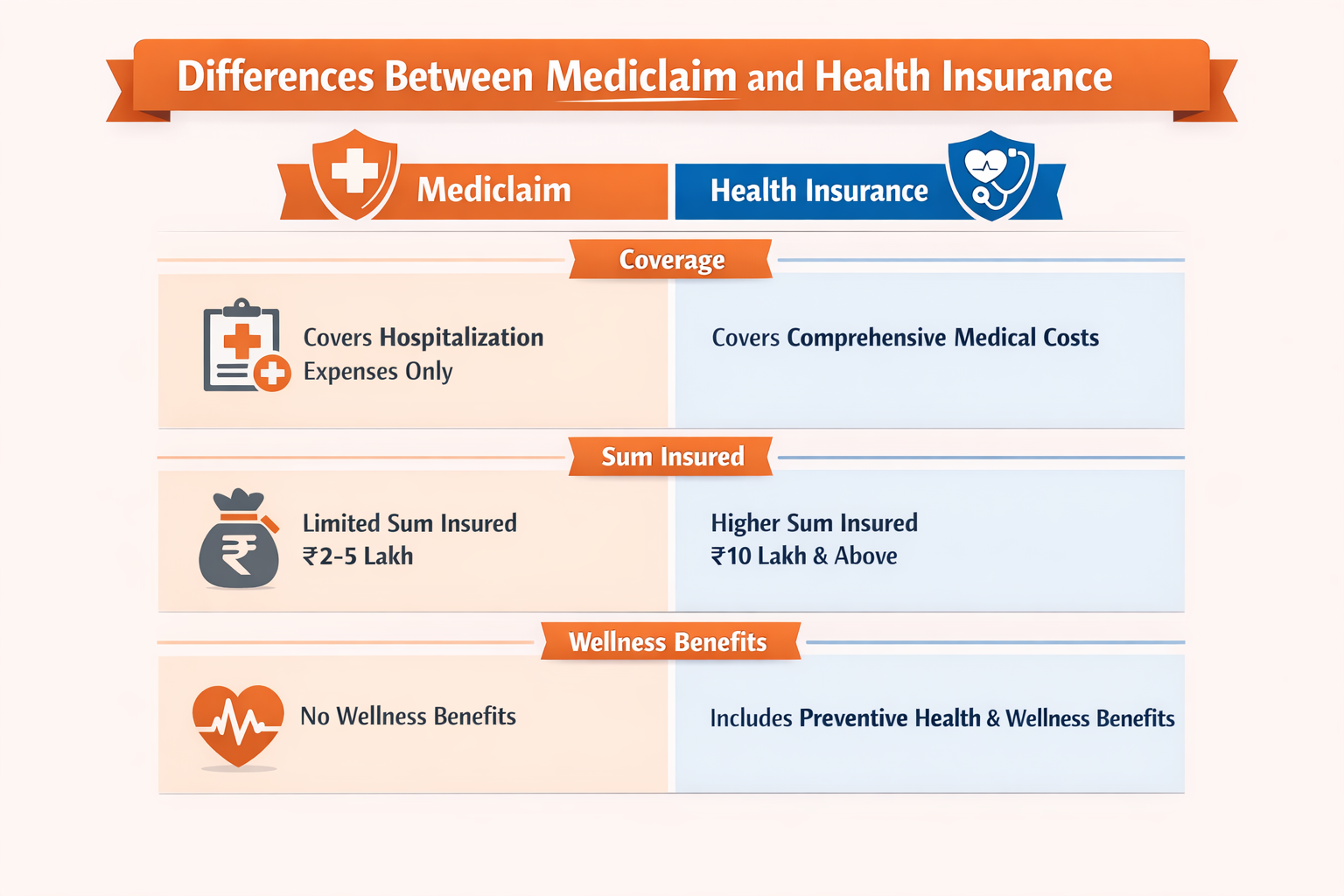

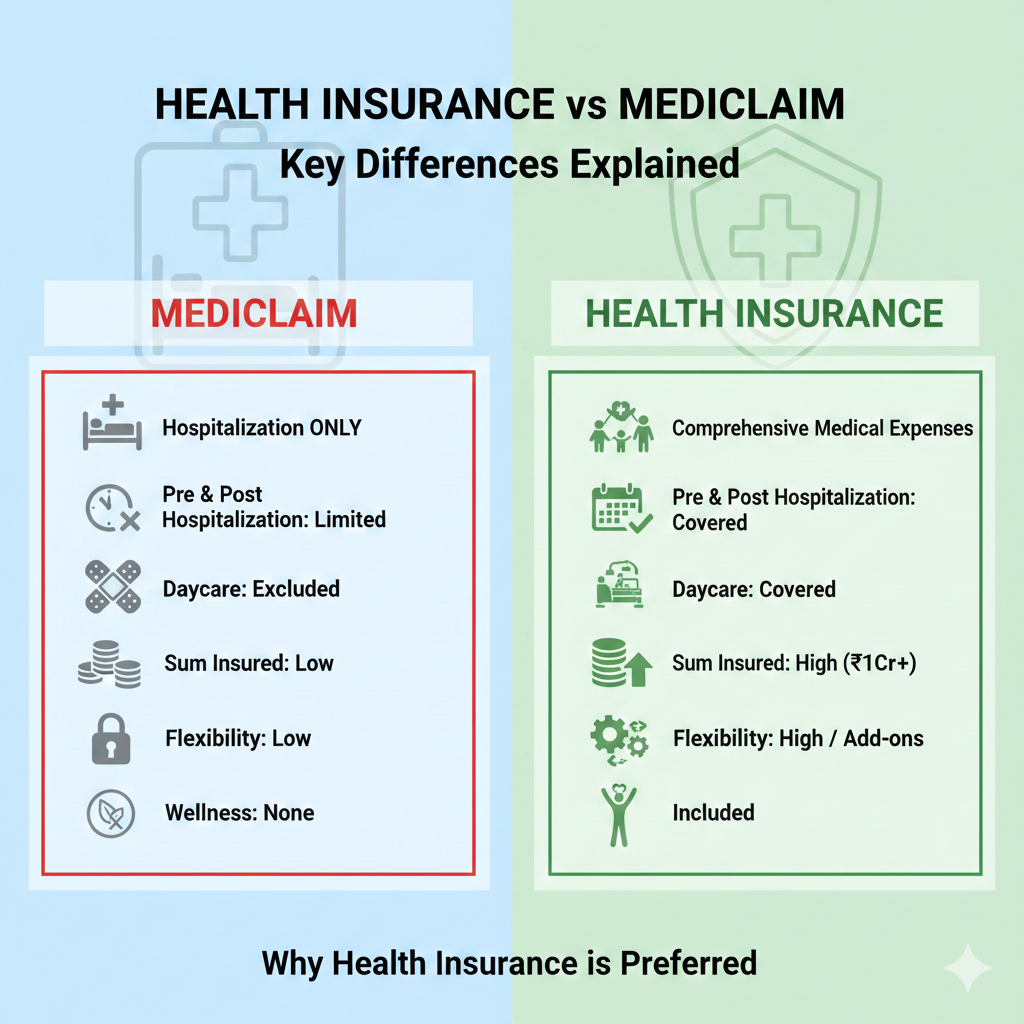

Health Insurance vs Mediclaim: Key Differences Explained

| Feature | Mediclaim | Health Insurance |

|---|---|---|

| Coverage | Hospitalization only | Comprehensive medical expenses |

| Pre & Post Hospitalization | Limited or none | Covered |

| Daycare Procedures | Mostly excluded | Covered |

| Sum Insured | Low | High (₹10L, ₹25L, ₹1 Cr+) |

| Add-ons | Very limited | Multiple riders available |

| Wellness Benefits | Not included | Included in many plans |

| Flexibility | Low | High |

This comparison alone shows why people increasingly prefer health insurance over mediclaim.

Which One Is Better: Health Insurance or Mediclaim?

The answer depends on your needs, budget, and life stage, but in most cases, health insurance is better than mediclaim.

Here’s why:

1. Wider Coverage

Health insurance covers:

- Hospitalization

- Pre & post-hospitalization expenses

- Daycare treatments

- Organ donor expenses

- Mental health treatment

Mediclaim usually stops at hospitalization only.

2. Higher Sum Insured

With rising medical inflation in India, a ₹3–5 lakh mediclaim may not be enough. Health insurance plans allow higher coverage at affordable premiums.

3. Better Cashless Network

Health insurance plans generally offer a wider cashless hospital network compared to mediclaim policies.

4. Long-Term Value

Health insurance policies reward you with:

- No Claim Bonus (NCB)

- Wellness rewards

- Premium discounts

Mediclaim offers minimal long-term benefits.

When Mediclaim Can Still Make Sense

Despite its limitations, mediclaim may be suitable in some cases:

✔ Senior Citizens on Tight Budgets

Basic mediclaim plans have lower premiums, which may appeal to seniors with limited income.

✔ Employer-Provided Cover Add-on

Some people use mediclaim as a top-up to corporate health insurance(you might like this).

Why Health Insurance Is the Smarter Choice Today

Healthcare costs in India are rising rapidly. A comprehensive health insurance plan protects you against:

- Long hospital stays

- Expensive surgeries

- Lifestyle diseases

- Emergency medical needs

According to the Insurance Regulatory and Development Authority of India (IRDAI), comprehensive health insurance provides better consumer protection and transparency.

Health Insurance vs Mediclaim for Families

If you’re buying insurance for your family, health insurance is clearly better.

Family Floater Advantage

Health insurance allows you to:

- Cover entire family under one policy

- Share sum insured

- Save on premiums

Mediclaim family floaters often have strict limits.

Cost Comparison: Health Insurance vs Mediclaim

Many assume mediclaim is cheaper, but that’s not always true.

| Policy Type | Average Annual Premium |

|---|---|

| Mediclaim (₹5L) | ₹6,000 – ₹8,000 |

| Health Insurance (₹10L) | ₹9,000 – ₹12,000 |

The additional cost of health insurance delivers significantly higher benefits, making it more cost-effective.

Common Myths Around Mediclaim and Health Insurance

Myth 1: Mediclaim and health insurance are identical

❌ False. Mediclaim is limited; health insurance is comprehensive.

Myth 2: Mediclaim is enough for young people

❌ Medical inflation makes basic cover insufficient.

Myth 3: Health insurance is expensive

❌ Early purchase lowers premium and increases benefits.

How to Choose the Right Option for You

Choose health insurance if you want:

- Complete protection

- High sum insured

- Long-term savings

Choose mediclaim only if:

- Budget is extremely tight

- You already have strong primary coverage

Final Verdict: Health Insurance or Mediclaim – Which Is Better?

In today’s healthcare environment, health insurance is clearly better than mediclaim for most individuals and families. While mediclaim may work as a basic or supplementary cover, it cannot replace the comprehensive protection offered by modern health insurance plans.

If you’re serious about financial security and medical peace of mind, health insurance is the smarter, future-ready choice.

Frequently Asked Questions (FAQs)

1. Is mediclaim the same as health insurance?

No. Mediclaim is a basic form of health insurance with limited coverage.

2. Which is cheaper: health insurance or mediclaim?

Mediclaim has lower premiums, but health insurance offers better value.

3. Can I have both mediclaim and health insurance?

Yes, you can hold multiple policies for enhanced coverage.

4. Is mediclaim enough for hospitalization in India?

In most cases, no. Rising healthcare costs require broader coverage.

5. Should I replace my mediclaim with health insurance?

Yes, upgrading to comprehensive health insurance is advisable for long-term protection.

1 thought on “Which One Is Better: Health Insurance or Mediclaim?”